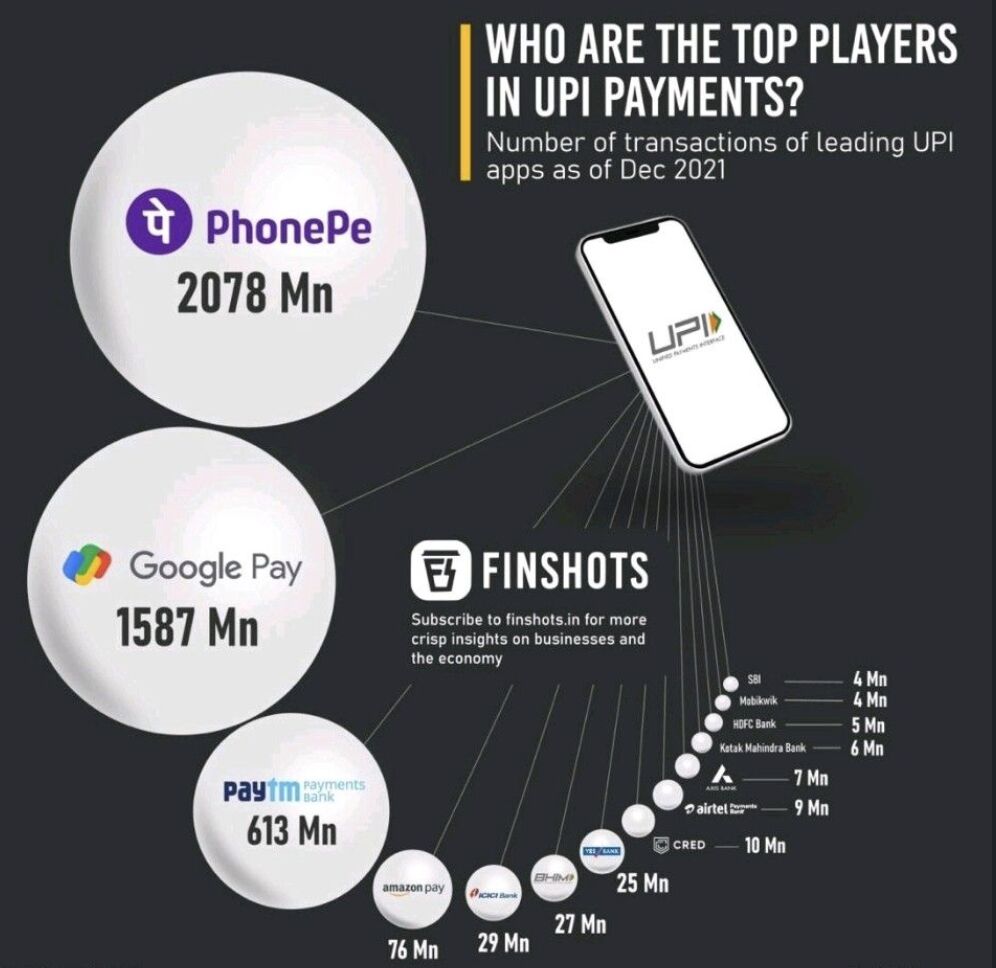

I do not believe that the below image paints a clear picture, most of these fintechs leverage banks(Yes bank helps clear and settle a lot of these payments along with others), regulations give banks an advantage.

* The fact is that the banks who have adopted collaboration as a business model have been more successful in comparison to bank who have tried to just compete.

* Fintech are a new segment of customers for the traditional banks and that is where the pictures starts to get a bit clear.

* Now, consider decentralized finance and its various dimensions, instruments (digital currencies), intermediaries(traditionally they were banks, now fintechs can do that) and infrastructure(traditionally central banks had the ownership, now various blockchain networks and by the virtue of #defi participants).

The central banks and traditional commercial banks DO NOT have an advantage here and that is where the picture is becoming very interesting and vibrant, and this is the real threat to the traditional banking industry.