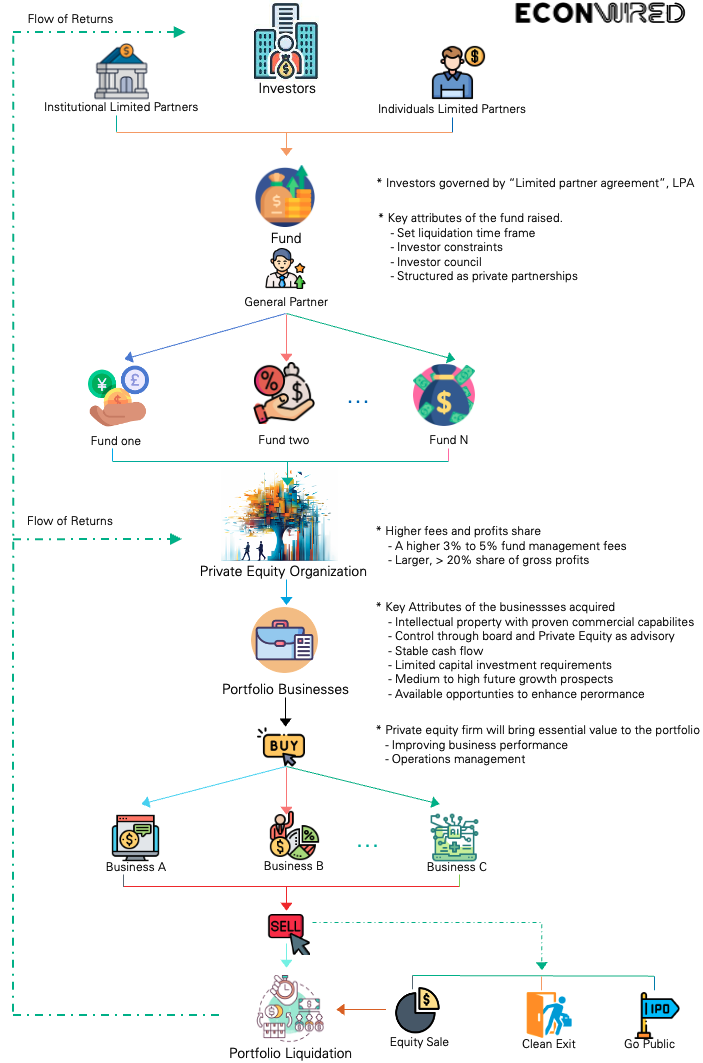

Imagine a private equity firm based in Americas, managing about $5 billion across various funds, running operations from New York and London. The year, 2023, has not been the most pleasant time for an investment organization, irrespective of type of investments they made. The bigger you are, the bigger is the risk you are exposed to. In these circumstances, it would be wise for private equity firm to diversify and find investments which offer much higher value for even a relatively smaller ticket size invested over a shorter time period.

The fundamental idea is to “hunt” for investment with relatively lower cost of acquisition but potentially larger returns over a much shorter period of 5 years. By one analogy, these investments could refer to “untapped innovation and intellectual property”, trapped in their current ecosystem, which could be a financial institution, fintech, large software vendor, etc. due to varied reasons. This could offer vibrant possibilities for a private equity firm that knows how to extract this trapped intellectual property and build a sustainable business around it relatively quickly.

This being the core thought, this paper attempts to explore a path towards building an investment portfolio with the objective to acquire untapped intellectual property hidden across the financial technology industry.

The paper(investment thesis) aims to focus on all aspects of a portfolio’s transactions; principles, and processes of “buying”, “holding”, and “exiting” businesses in the portfolio along with possible financial return scenarios over 5 years.

Observations; Facts, Risks and Opportunities

Financial services industry is estimated to be $12.5 trillion, and out of which about 2% is financial technology or Fintech industry, about $250 billion and this number is expected to increase to 7% with banking technology representing 25%.

According to BCG, Fintech is projected to become a $1.5 trillion industry by 2030.

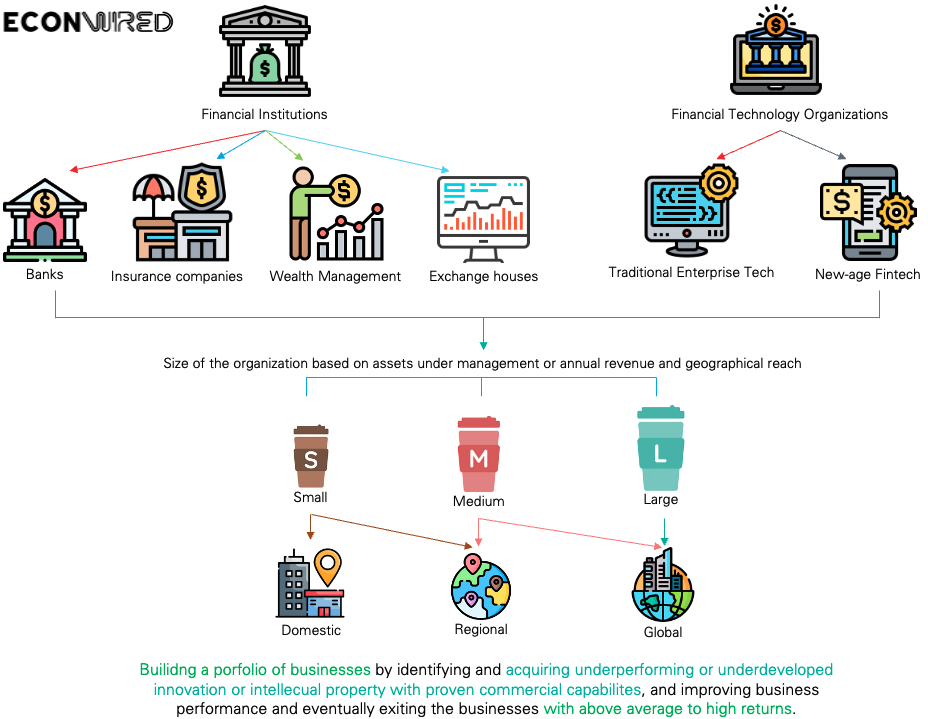

“Financial technology” or “Fintech” is a general term usually used to describe a large technology ecosystem that covers organizations across financial infrastructure, intermediaries and instruments that are leveraged to offer financial services in various form of transactions to a large array of customers; individual, mSMEs, large corporations, and governments amongst others.

The financial services industry includes banking of all sorts; retail, corporate, investment, and all its offerings such as taking deposits and lending. The industry would also include the insurance market, capital markets, wealth/asset management and a large layer of payments infrastructure that is usually the last leg that completes all types of financial transactions.

Financial industry also represents the technology disruption challenging the fundamentals of finance, such as, questioning who controls the currency. These ideas and organization aim to improve the traditional financial offerings and create new offerings for the world economy.

Blockchain, the idea of decentralized finance, regulated and unregulated digital currencies, artificial intelligence, virtual worlds of the metaverse and much more, would have similar objectives.

Opportunities

Financial tech is a large industry by most standards and innovation is not necessarily a scarce asset, but innovation that finds commercial success is probably a very small percentage. Most of the innovation is represented in some form of intellectual property and in many of cases it remains “trapped” within the financial organizations like banks, exchange houses, insurance firms and financial technology(fintech) organizations all across the world. In such cases, the intellectual property is usually either part of a larger business unit, overshadowed or in complete neglect. Reasons could be varied; priority, lack of resources, restricted vision for the IP, and more.

This could be a great space to explore for a private equity firm, targeting a segment which is not organized well enough for VCs to invest in, and too small for larger private equity firms to focus on.

Risks

An obvious risk would be to achieve a clean break from the parent organization, which can prove to be complicated and may require substantial resources. Operational risks after breaking off are very real as well, the weight that the business would have, specifically with regards to approach and mindset will need a major overhaul.

Running and scaling the business to a 3x to 10x growth can prove to be a challenge, especially in the current macroeconomic environment. A strong sales and distribution process would be essential to scale. Exiting the business at the right time can be a major blocker and considering the size of these businesses, problems may also arise with regards to the right valuations, hence building an exit strategy for the entire portfolio would be important.

Proposed Strategy

Any innovation which commands commercial potential is not easily accessible, and even when it is accessible, the competition to acquire it is intense. Depending on the size and growth stage of the business, venture capitalists and angel investor of all sorts would be in line to get a piece and businesses where innovation has led to a more mature stage, they would have private equity firms all over it.

The Hypothesis

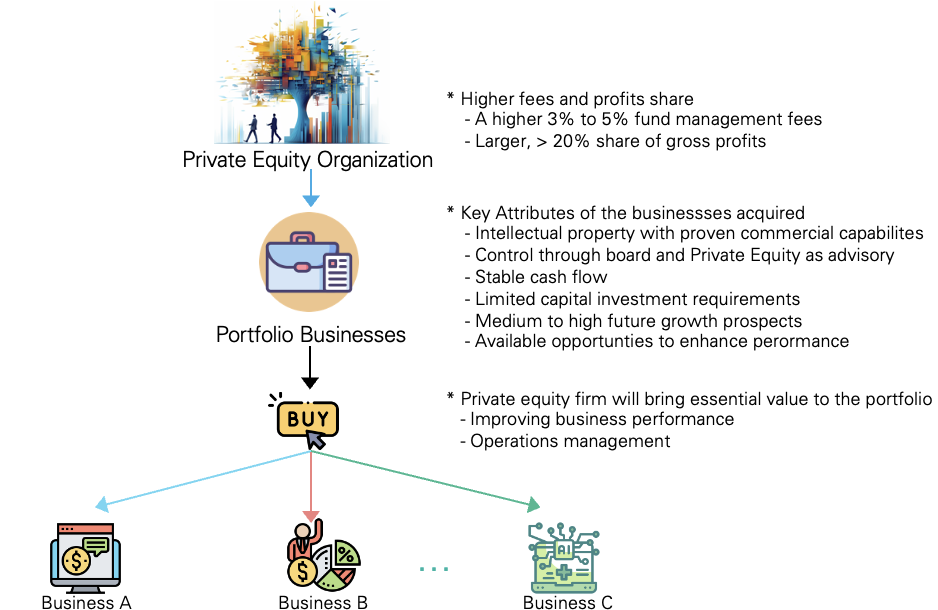

If a private equity organization can identify large organizations in the financial industry that have incubated innovation in form of intellectual property with proven commercial potential and once identified, if the private equity firm can acquire and execute the businesses to a sustainable recurring revenue, eventually exiting the portfolio in 5 years. Leveraging heavily on the execution capabilities of the private equity firm, this approach can offer a relatively higher value for every dollar invested.

It would be critical to have a high-level view of the following fundamental questions while building a portfolio strategy to execute the approach described above,

- What would be the target segments and how would the businesses be acquired? Defining the target segment and approach to acquiring businesses.

- What would be the execution approach? Defining a path to sustainable annual recurring revenue for the portfolio.

- What would be the exit approach? Defining path to a tactical exit in a given time period.

What would be the target segments?

Defining the target segment and acquiring businesses for the portfolio.

Innovation usually originates from a “problem”, or because of a process to discover a better way to achieve an “objective”, irrespective of the fact that if the process was intentional or unintentional. In the financial industry the “problem” and the “objective” are usually better understood by the consumer of the technology and in many cases, they take the first attempt at building solutions. Hence Financial institutions and financial technology organizations could potentially form the largest source of untapped innovation and intellectual property in the industry.

Financial institutions

In the financial technology industry, financial institutions are the consumers of most of the innovation in the industry. The fact is, financial institutions are usually the closest to their “problem” and “objective”, they know it better than any external organization and yet most of the innovation comes from outside of the FIs. In most cases what FIs lack is a mindset to build something that may be relevant outside the boundaries of their very bespoke needs and most likely is a distraction to their daily objectives.

A financial institution can be a bank, insurance firm, exchange house etc., and they don’t always outsource innovation, in some cases an inhouse build might create rough products and services that have been tested and implemented in the organization and maybe even sold to a subsidiary organization. These intellectual properties could have untapped commercial potential, which could extend domestic boundaries of the financial institution. Financial technology organizations

Financial technology organizations

Technology vendors serve as the key source of innovation for all types of financial institutions across the world. These include traditional independent software vendors of all sizes, and new age fintech that offer business innovation along with technology innovation. But not all innovation is given similar focus. As a business, the pressure of achieving time bound commercial targets is intense, and most of the focus usually moves to the intellectual property that is generating revenue. In this process, a lot of tech. is left neglected or underdeveloped.

Financial technology organizations can potentially have an abundance of untapped intellectual property.

Small and medium size technology vendors (independent software vendors), with annual revenue of $5 million to $150 million usually have products and services that either see some sort of neglect or the commercial potential of these IPs is limited by their parent organization’s capabilities. These limitations could be due to geographical reach, execution, and management capabilities, or even vision and appetite.

Large financial technology vendors, with annual revenue exceeding few hundred million US dollars, could have products and services that offer value and demonstrate a high potential for growth, but in this case “value offered for the dollar invested” is questionable. Also, this segment is exposed to intense competition from other private equity firms.

New age fintech firms offer innovation in terms of technology along with business innovation, and the value delivered because of the combination has tremendous potential. The high valuations reflect this potential.

This segment is usually the target of VCs and angel investors. The proposition usually is to offer “capital” for some equity and in most cases controlling stake is not on the table.This segment won’t really fit the term “untapped potential” for the value that is expected.

Extracting business from the parent organization

Acquiring innovation or the intellectual property with a proven commercial potential from the parent organization is a critical step in the overall portfolio strategy. It is recommended to constitute a team of industry experts with global experience in varied financial markets with a holistic perspective.

This team of industry experts along with investment team would lead a line of questioning and analysis, similar to the following points, to gauge potential of the intellectual property under consideration.

* Which are the most successful in-house builds of financial institution?

This would offer a view of all “in-house builds” of the financial institution that have had success in the last five years.

* Which of these builds does the financial institution believe that other similar FIs would need?

A financial institution would have a diversified set of talent with exposure from the industry, who can provide a view if other FIs would need a similar solution. This would be a peak into the commercial potential.

* Which independent software vendors in the financial institution group offers the most value?

Leveraging the FI being analyzed to reach domestic or regional value is a good idea, which would feed other parts of the target segments – financial technology organizations.

* Questions for the financial technology organizations should be similar, trying to reach the asset they may not have the resources or intent to focus on but has proven potential.

Framework for extractions of the businesses/IP from the parent organization

Once the IP is identified, the combination of the below steps can prove to be an effective framework for extractions of the businesses or the intellectual property from the parent organization.

It is recommended to focus on intellectual property from industry segments and sectors that show high potential over medium to long term, instead of something that may just have a “buzz” without real applications.

The intellectual property should include a “core team” from the parent organization that would be responsible to run fundamental operations in early stages after extraction including R&D, product, operations, and basic sales. The core team is essential for the business to succeed, this structure would form the basis for everything that the private equity firm would do to scale the business. Caveats should be in place legally that protect the IP and the core team against competition from the parent organization.

Commercials would probably be one of the most important variables in deciding if this extraction would go through. The following options or a combination of these can be considered as the base,

* A clean buyout should be preferred for a 2x to 2.5x multiple of the current revenue (if any). A reasonable valuation would be a good start towards a profitable liquidation of the business in a few years.

* An equity share, with the private equity organization owning a much higher stake than is needed for controlling rights in the business. A 10% to 15% equity offered to the parent organization to keep them involved and hooked.

* A profit-sharing model adding to the parent organization’s cash flow. This would be cashflow they would most likely not see if this deal doesn’t go through and with time the IP anyways would become irrelevant for the market.

What would be the execution approach?

Defining a path to sustainable annual recurring revenue for the portfolio.

As the business is added to the portfolio with established clarity that there would be a market for the business, the focus should be to build a path to a sustainable recurring revenue. This part of the strategy would possibly be the most critical and resource intensive for private equity firm.

* Reorganizing and cleaning up the overall corporate structure of the business should be a priority, embedding the principles of efficient operations early on in the process would be a good start.

* R&D and the product organization of the business should be invested in to build the “MOAT” and be aligned with the core objective of commercializing the intellectual property in the short to medium term.

* Private equity firm should leverage its distribution network that can reach global customer base and scale revenue relatively quickly. Short sales cycle with aggressive pricing and fee strategy along and a frugal and aggressive marketing strategy would expedite this process.

* Recommended approach is to build the product portfolio of the business around “As a Service” model based on cloud native tech stack, with services divided up in independent capabilities that can be offered at smaller ticket size. The pricing strategy should be aggressive in terms of the ticket size, flexible in payment terms with a focus on cash flow and profitability and realizing revenue as soon as possible in the sales cycle. This approach would reduce the effort needed to breach the barrier towards a scaled-up sales and revenue model.

* Collaborations with larger players should be leveraged as catalyst to boost sales, enter new markets, and customer segments. It recommended that the business should focus on scale with this approach rather than profitability. Building a larger customer base with lower margin is a good strategy in the short term.

The objective should be to achieve a 5x to 10x growth in 5 years, considering the small size of the businesses in the portfolio, this is plausible scenario. What would be the exit approach?

What would be the exit approach?

Defining path to a tactical exit in a given time period.

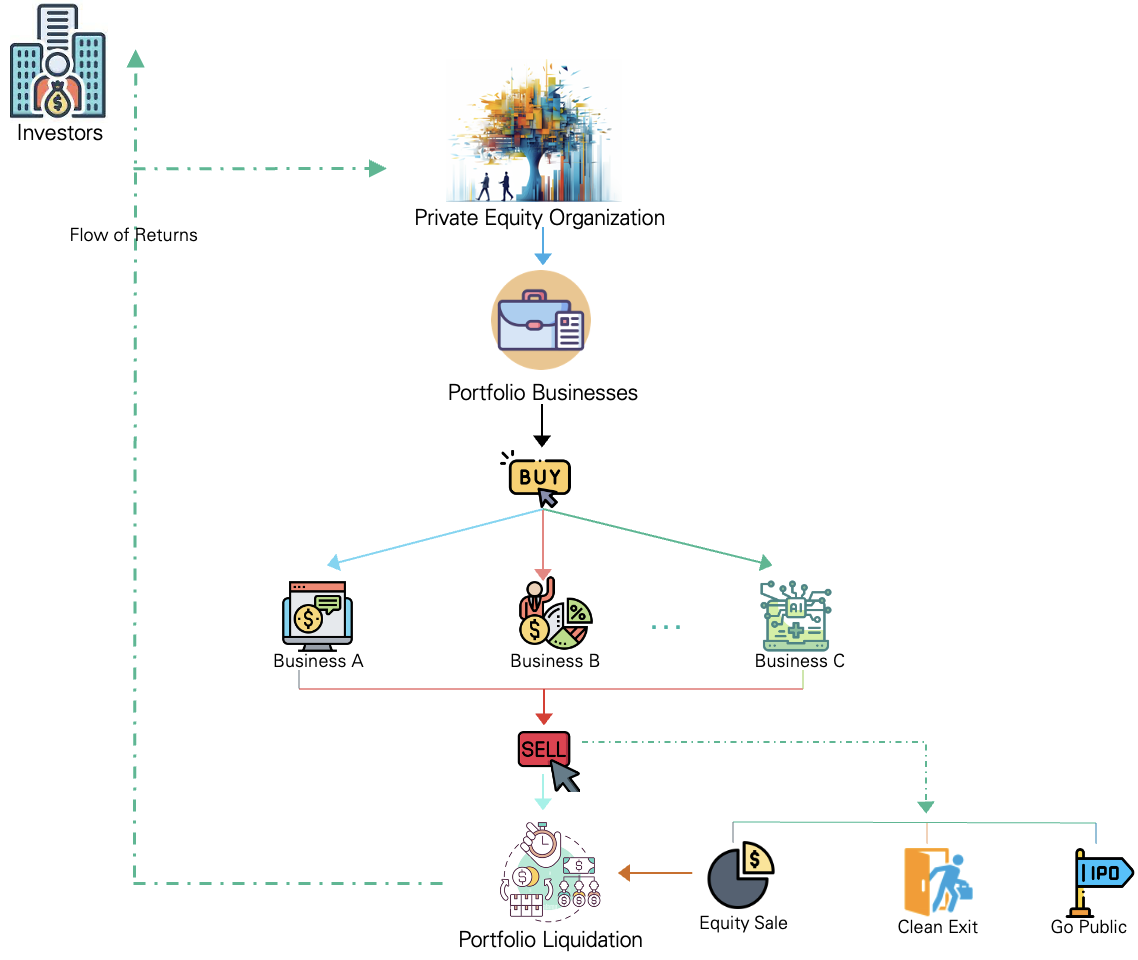

Assuming that while adhering to the above-described approach, the private equity firm acquired 10 businesses, with each business generating approximately $1 million in annual recurring revenue.

Assuming a 2.5x multiple (may be even less) at an average valuation of $2.5 million each, a total of $25 million is invested to build the portfolio. Over the next 5 years, it would not be an unrealistic event if the business achieves 5x to 10x growth. Assuming that an average growth of 5x revenue was achieved for the entire portfolio.

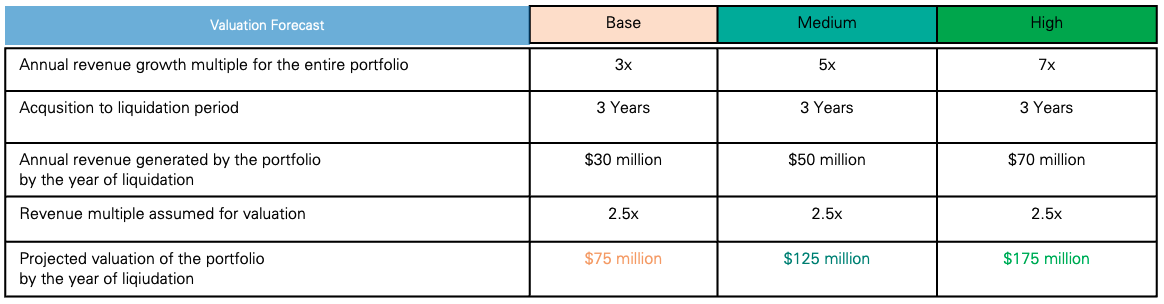

Considering the above assumptions as the base, the following base, medium and high valuation scenarios are possible.

At a medium 5x average growth, the entire portfolio can generate $50 million in annual revenue, and at a conservative 2.5 times multiple, valuation of the portfolio could be around $125 million. Assuming a high 7x growth, the entire portfolio would generate $70 million in annual revenue, and at a 2.5x multiple, portfolio can be valued at $175 million. If a base growth of 3x is considered, the portfolio generating $30 million in annual revenue can still be valued at a fair $75 million.

Depending on the macroeconomic circumstances in 5 years, an appropriate valuation multiple could be 3, 4 or even 5 times, but unlikely that it would go below 2.5 times, this could make the returns much more interesting.

If the process of identifying, acquiring, and executing the business is done right, exiting the portfolio over a period of time would be a relatively smooth process.

The above-described approach is very operations intensive; it would help support the argument of a higher fund management fee of 3% to 5% or/and higher profit sharing, relative to the industry standard of 20% of gross profits at dilution.

Commercial scenarios resulting from a stake sale or complete dilution of the business will be a more probable scenario than an IPO. An IPO is unlikely scenario unless the portfolio is kept for a much longer period than a recommended 5 years.

Based on the approach described in this document, there are a few key assumptions, which are absolutely critical and are fundamental to execution of this strategy.

- Appropriate funding, a fund of at least is necessary $50 million to achieve some level of diversification in the portfolio.

- Strong execution team, running world class product, operations, and sales organizations.

- An established sales and distribution networks in financial industry.

Conclusion

Finding the right bets and executing them well, is the oldest play in the book, but the above-described approach really finds this statement at its core. Financial institutions and financial technology organizations are the closest to their problems and objectives, with a limited interest in commercializing their solutions. If a private equity firm can capitalize on this highly operations intensive model due to the highly diversified nature of the portfolio, strong returns are possible.

Follow Ajay Singh Pundir on LinkedIn Follow ECONWIRED on LinkedIn