Corporations grow when they innovate, creating new categories, and establishing monopolies in these segments. Building monopolies for as long as possible has been a major objective of corporate leaders. Innovation is usually perceived as related to “a product”, but in many cases, “business innovation” via M&A, corporate venture capital, VCs, or partnerships is as critical if not more that “product innovation”. In situations where capital is in healthy surplus, business innovation can prove to have a relatively bigger impact.

Future of a corporation, in my opinion is dependent on strength of following three loosely coupled departments within the corporate structure,

- Corporate Strategy

- Mergers and Acquisitions (M&A) and

- Corporate Venture Capital

A corporation’s perspective on CVC

A large corporation, (usually with annual revenue exceeding billion US dollars) has a relatively slow pace of innovation, which leads to missed opportunities or sometimes even zero visibility of opportunities.

Corporations’ strategy is focused on the short term and quarter to quarter results dominates decision making, and allocation of investments. Long term ambitions are not really ignored, but in most cases key stakeholders are aware of the potential disruptions coming their way, it’s just that these are not priority for them, yet.

The ownership and cap table of a large corporate is usually complicated, and in cases where it is simple, for example, in cases where it is owned by a private equity firm, in any case the decision making is skewed in favor of the intentions of the stakeholder, which might be directed towards making profits or making an exit in the short term.

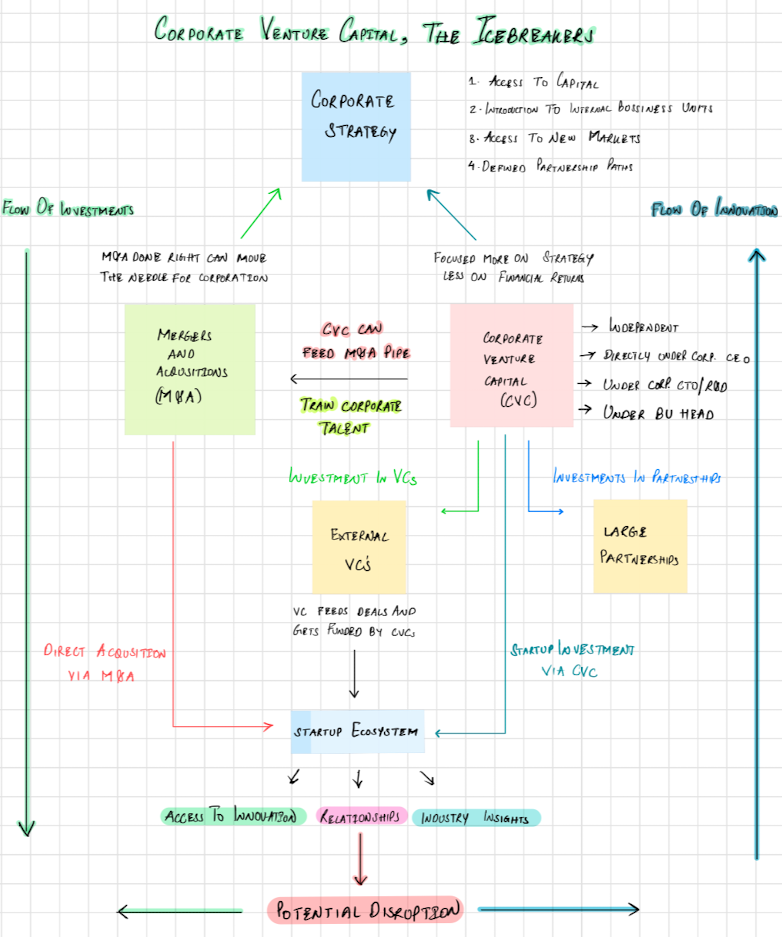

A corporate venture capital arm of a large corporation can help scout “startups” directly or via a venture capital firm, giving the corporate strategy department wings. Access to innovation, relationships and industry insights via the startup ecosystem can make a corporation’s “Corporate Strategy” and “M&A” departments highly effective. CVC can be positioned at various levels in a corporation’s structure; it could be independent under the CEO, under a certain dominant business unit, under the control of the CTO/CPO. The degree of autonomy a CVC has will decide the results that it would produce over a period.

Google with YouTube and Microsoft with its investment in OpenAI are good examples where corporate innovation and then acquisition of startups in certain fields have made the corporate strategy of these large corporations made them stand at pole positions in their industries for many years.

A startup’s perspective on CVC

A startup at any stage of its existence will require a lot of resource to grow and even survive, the following would definitely make to the top end of the list,

- Capital, access to funds.

- Large customers, access to strategic customers, like the large corporation which are subject of this article.

- Expansion, access to new markets.

- Partnership, defined paths to collaboration.

A large corporation, via its corporate venture capital arm can provide all of this to the right startup and potentially become a catalyst in the startup’s growth.

It is possible for a CVC to become a hinderance in a startup’s growth and the direction of its growth, or a balance in the relationship is essential for this to work.

A Venture capitalist’s perspective on CVC

A VC has access to the startup ecosystem, that the large corporation needs this. In return the CVC can offer strong capital, and usually these transactions are very tactical for VC’s. A “fund of fund” is an important strategy for CVCs to diversify investment, VC’s in specific space can leverage to fulfill their fundraising.

A M&A arm’s perspective

M&A arm of a large corporation needs access to startups that are strategically important for the corporation, and the CVC arm can make this hunt way more effective. CVC could potentially build up the pipeline for M&A to execute in the long term and also train professionals to be effective in the M&A function.

CVC’s are still one of first casualty when things go south in a corporation, despite what it brings to the table. Major reasons include its focus on being focused more on strategy rather than financial returns, it is seen as a cost center.

The following are the most active CVCs in 2023.

All these players combined, CVCs, VCs, and Startup ecosystem, form a symbiotic relationship, where the “flow of investment” from corporations down to the startup ecosystem, and “flow of innovation” from startup ecosystem right up to the large corporations are essential for occurrence of disruption of any kind to happen in any industry. CVC, in my opinion is the “icebreaker”, that every large corporation should consider investing into, to have a chance to access the most elusive tool for hyper growth, “disruption”.