Imagine a financial technology startup based in a country in the Middle East and North Africa region, centered around open banking and embedded finance, with an ambition to run operations in the entire region.

The startup has raised a “bit” more than a seed fund, which in the year 2023 could be anywhere from ~$2 million to ~$5 million.

The puzzle includes the following key pieces among others, which should be considered,

- Problem set to choose from (B2B/B2C etc.)

- Customer segments

- Regulations

- Traditional banks

- Fintech ecosystem

- VCs/Angels/Corporations

- Executive talent

How would the startup go about building this business with a strong recurring revenue, over the next 5 years?

This piece attempts to highlight a possible path that the financial technology startup can take to build a sustainable recurring revenue.

Facts, Risks and Opportunities

Regulations are one of the most crucial parts of the strategy, if not the most important. A regulatory mandate against or in favor of a startup’s strategy can make or break the business. Building a relationship with regulators is important.

- In most markets, regulations move slow, and if the objective is to run operations in multiple countries, this complicates things further.

- Besides the speed, in most of cases, a countries regulations are built in phases, so the entire framework worth leveraging is usually incomplete. This introduces a big element of uncertainty in the process of building a strategy.

Barrier to entry is not too rigid, but sustaining a business is all together a different story.

- Competition in financial tech is intense, at least on the surface, everyone and their uncles are building a financial technology startup. So, finding the right customer segment and not spreading too thin is critical.

- Seed funding could be relatively easier to raise, but a financial technology startup needs consistence funding across various rounds, which is a lot of work and not necessarily certain. Reaching the end of the road due to lack of funds is a very real scenario in this world.

Partnerships are important, dependency on traditional financial institutions is high, contrary to popular opinion. Commercial banks and central banks are essential stakeholders on the current economic framework, and they are not going anywhere anytime soon.

- Banks need new business, and a startup can give them access to new business and innovation (capabilities) which eventually may strengthen their position in the larger context.

- As a startup, leveraging services, distribution networks and customers of other financial tech startups is essential. Riding on the success of others in the ecosystem for a cost is an essential part of the strategy which absolutely be high on priority for founders.

Proposed Strategy

There could be many paths that a startup can take in this context, below described approach is a “possibility” (“possibility one” in the series of similar papers).

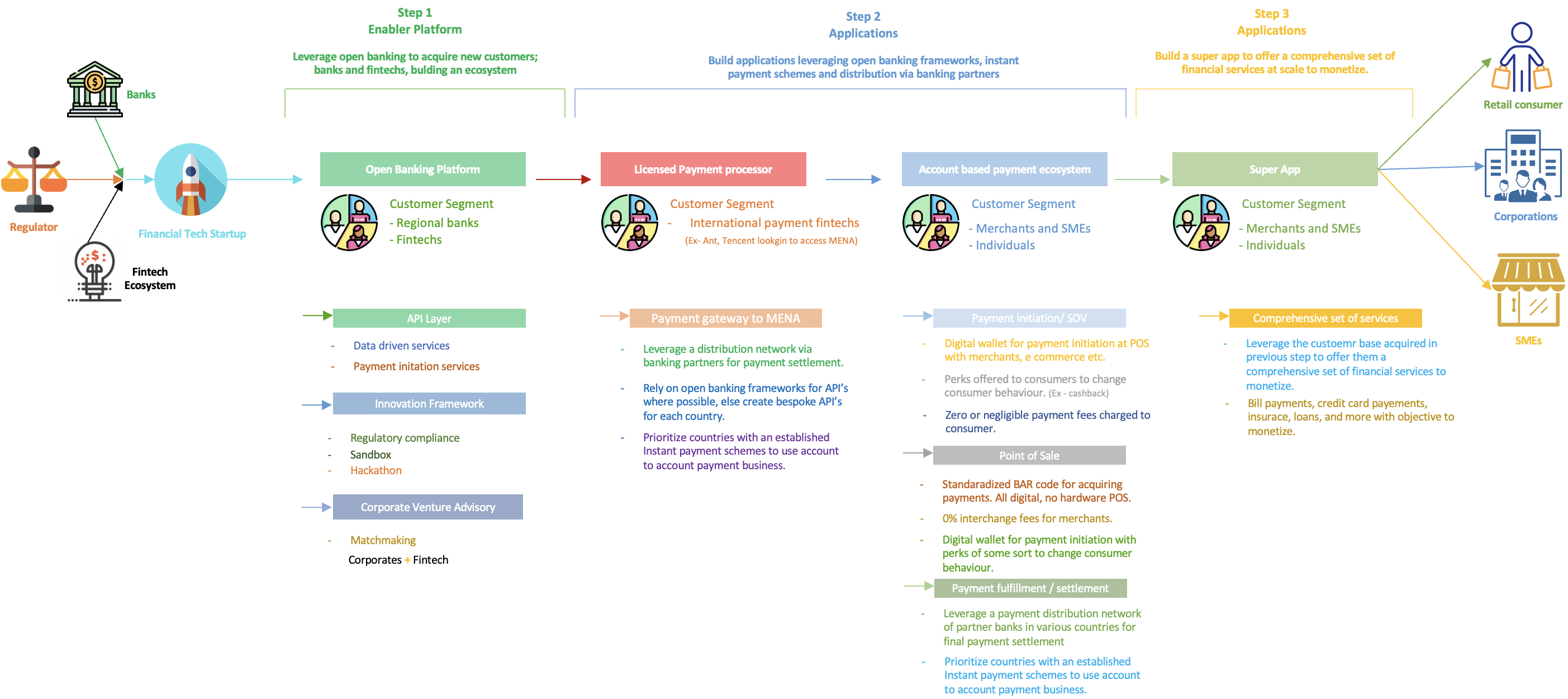

Building a customer base is a mission critical part of a startup, but a distribution base for fulfilling the services that the startup would offer is important as well. The proposition is to take a three-step approach in building an ecosystem that can be monetized over the next 5 years.

It is essential that the start build a strong partnership strategy, for all key stakeholders, regulators, traditional financial institutions, fintech, for this approach to work.

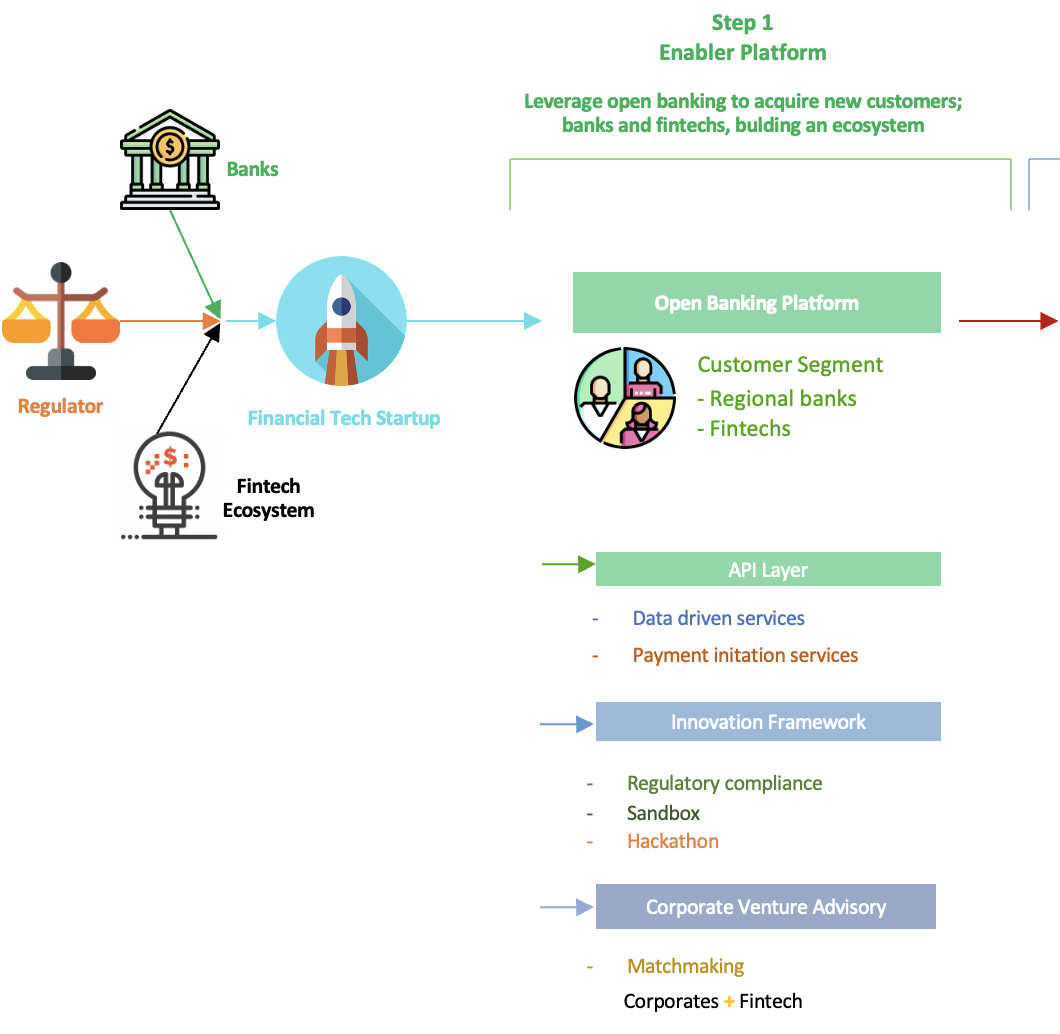

Step one, the objective is to focus on open banking regulations and getting various licenses needed to get involved in the ecosystem and become an “enabler platform” for other startups and financial institutions.

Most countries in MENA have started building policies and infrastructure towards achieving open finance; open banking framework, API standards, and a more efficient transaction fulfillment systems like instant payment schemes and electronic mandates. Relationships with the regulators are essential for this step to be executed.

This “enabler platform” will connect fintech startups and financial institutions (mostly banks) building a distribution network for acquisition and settlement of transaction volume. Leverage the distribution network to building application and ecosystem for the retail (B2C, C2C) with focus on account-based transaction banking.

The platform will offer APIs for access to data and initiating payments to startups, while partnering with banking financial institutions.

Access to innovation framework, a sandbox, and any resource needed to test out new services using the tools that the regulatory framework offers.

Ideally in 18 months, the result should be a base of startups and banking financial institutions as part of the ecosystem and a credible brand as an “enabler” in the market, that can be replicated in other market in the regions in some form given appropriate funding.

At this stage the startup will most likely need to raise funds for growth.

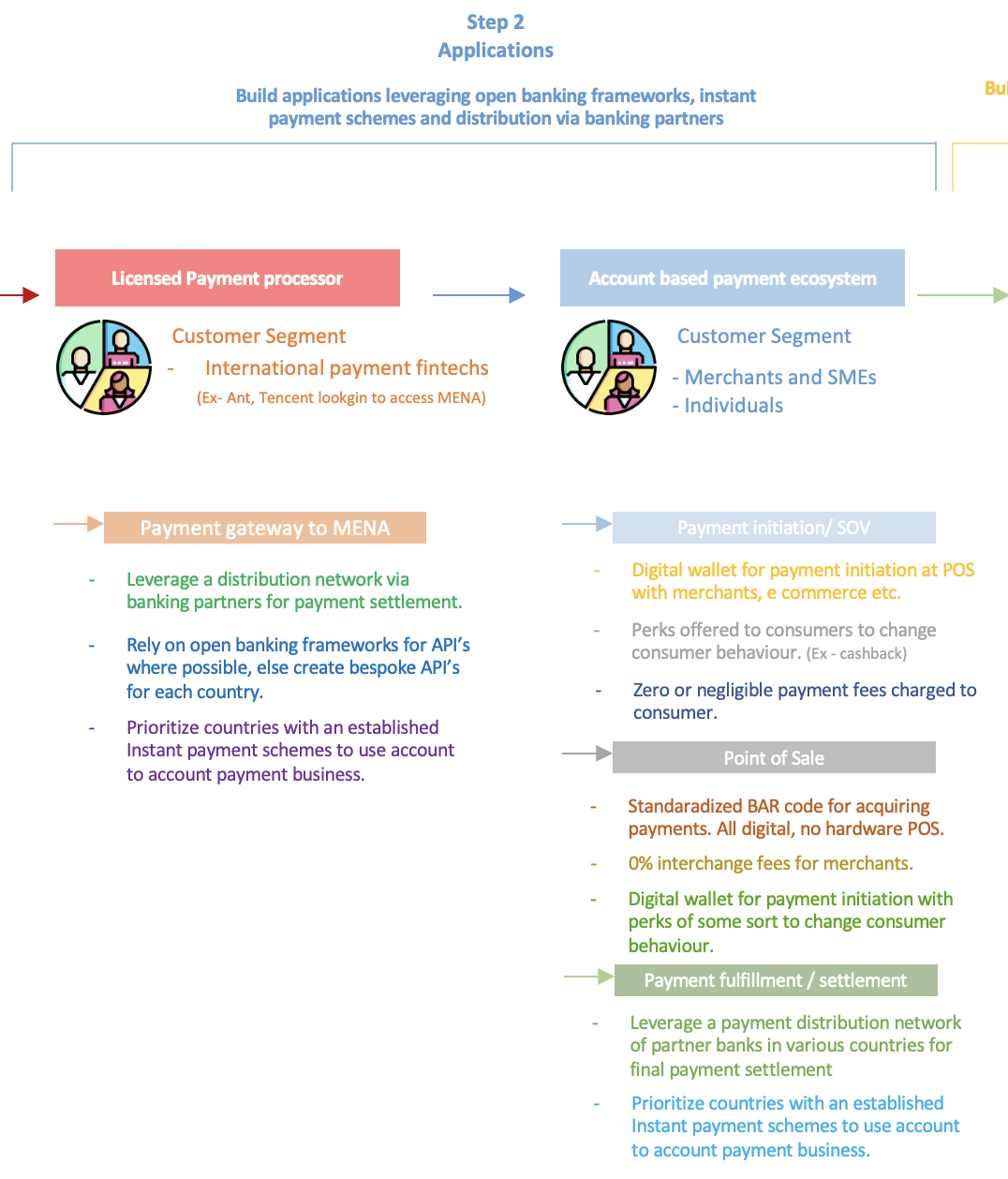

Step two is where the financial technology startup will start leveraging the fintech and banking distribution network to build applications to service the need of corporate customers.

Payment processing is a very real problem for various corporations and add a multi-country angle to it along with regulatory needs in each country and it becomes a major issue for large multinational corporations, regional payment companies and even local startups. Access to payments infrastructure in countries in MENA is no different.

The first application that the startup should consider building to cater to the above need, is a licensed payment processing system offered as a service to larger corporations, regional payment companies outside MENA.

A focus should be on account-based payment processing and settlement via open banking framework to acquire payment and payment data and settle preferably using the instant payment network in the country.

Many countries in the MENA have “incomplete regulations”, so either the APIs are not standardized, or the policies are not concrete. The payments infrastructure is not strong or in the process of being built, all in all a substantial degree of uncertainty. To mitigate this risk, the startup should consider prioritizing countries with strong instant payments infrastructure and preferably open banking framework.

Countries where the infrastructure in not strong, a good way is to work with all stakeholders, including regulators to agree on standards (APIs and laws) and best approach to achieve value. Organizations like mPesa in Africa, and startups in countries like India, where there was no clear open banking framework, even though a strong instant payments network, are good examples of this approach.

The ideal result at this stage would be a strong ecosystem of fintech’s that needs transactions to be fulfilled and a network of partner banks that fulfill these transactions. Creating a value unit that is essential for both sides. This ecosystem would be the base to enter the “retail” market.

The next part of the Step two is to build an account-based payments infrastructure as an alternate to card-based infrastructure, offering products and services at every part of the supply chain.

A payment initiation via bar codes and digital wallets for individuals to initiate payments. The consumers would not be charged for the payment or be charged a very negligible fee. Merchants on the other hand would be charged zero interchange fees for the service.

A major issue in MENA would be the consumer behavior, using a cards-based wallet is very convenient. To change this behavior, offering perks like cashback would be necessary.

Point of sale at the merchant, without using any hardware POS, instead using standardized bar codes, as being done in India and China, with zero interchange fees.

Payment fulfillment and settlement leveraging payment distribution network via partners banks in various countries acquired in previous steps.

The ideal result at this stage would be a strong retail customer base, along with fintech’s and banking partners and a financial tech brand that is on an accelerated growth.

Step three is where the financial technology startup is ready for a focused monetization of the ecosystem. Building a comprehensive set of financial services offered in a form of application which the industry calls a “super app”.

Leverage the ecosystem that was built in prior steps, that has retail customers, merchants, corporations, and financial institutions to offer services like lending, insurance, bills payments, and use cases that have not been conceived yet.

A good example is Alipay in China and Paytm in India, which have become behemoths in their countries.

Conclusion

There are multiple paths a startup, centered around open banking and embedded finance can take, this would probably be a longer one, but it would build an ecosystem which will be sustainable and give room to pivot in a disruptive industry. More to come stay tuned to ECONWIRED.COM.