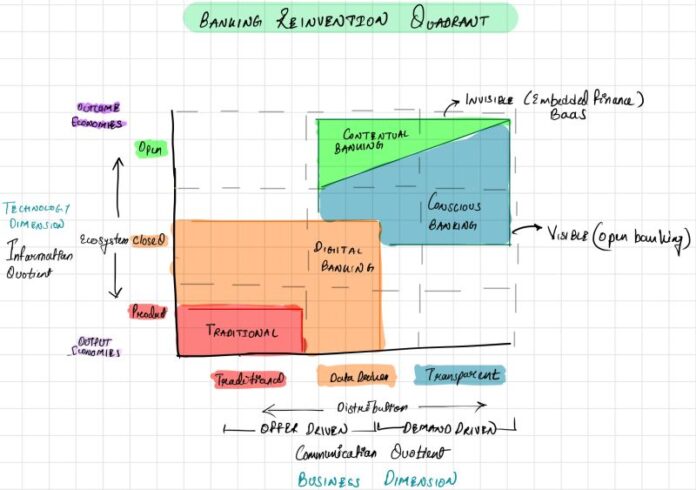

The “Banking reinvention quadrant”, a framework described by Paolo Sironi in his book “Banks and Fintech on Platform Economies” provides a tool to build a business map and a vision.

Measured across two dimensions, “Information” which describes the technology aspect of banking and “Communication” that describes the business(distribution) aspect of banking.

The argument is simple, banking is evolving towards a distribution model where an open ecosystem is leveraged to build demand driven offerings, communicating transparently, with a focus to achieve “outcome” rather than “output”.

In this whole context, banks play an important role, but they may not necessarily be visible in the transactions. Two interesting concepts that the frameworks describes are ;

* Conscious banking – A transaction where data and technology is leveraged to provide a better experience (far better than traditional push based models) and banks are visible in the process.

For example, the growth of “Open Banking” regulations allow for an open ecosystem to build better banking services majorly using customer data and APIs as integration mechanisms.

* Contextual banking – A transaction where banks are absolutely invisible, but the applications of banking are very much part of the context. Embedding banking services in the journey of the customer and building outcome economies. Banking as a Service is a good example of this approach.

I believe banking is evolving at an accelerated pace, and contextual/conscious models are already dominating our lives, and market capitalization. It is a matter of time that banks, as we know it will probably be limited to providing risk management layer, everything else; technology and business, will be owned by non banking entities, and I doubt the world will complain, given the perception of trust is protected.