Imagine a “Corporate Payments” startup based in a country in the Middle East and Africa region, with an objective to go global over the next 3 years, starting with MEA. Below points describes key attribute of the current circumstances for the startup.

- The startup has a good product and solution portfolio based around “transaction processing”, which in theory, can cater to financial institution of any size, large corporations, and payment fintech leveraging a strong R&D and product team that continue to innovate.

- The startup is bootstrapped and have about $3 million in the bank from sales in the previous fiscal year, proving the concept and possibility of a market.

- Immediate priority is to expand and replicate the business in other key markets in middle east, Africa and eventually moving into Europe and LATAM.

How should this “Corporate Payments Startup” go about building a sustainable recurring revenue over the next 3 years?

This paper attempts to lay down a potential path.

Corporate or B2B Payments represents a market attempting to solve the “problem” of payment processing for financial institutions, large corporations, payment fintech. Payment processing might seem like a straightforward process on the surface, but any system that deals with “money” and “transfer of money” is usually have a high-level of complications. Some of the key reasons that cause complications are below –

- Increase in the number of payment initiation sources for FIs(banks).

- Ever-changing and sometimes incomplete regulations and policies.

- Rise in electronic payments volume which also leads to higher risk of fraud and other illegal acts around money transfer.

- Technological advances and shear number of non-banking institutions that have entered in a predominantly traditional market.

- Customer expectations, they rise, and they rise.

Financial institutions, large corporations, payment fintech, and anyone who needs to manage a substantial transaction volume usually must face these issues. In an attempt to solve for these problems, a small market has been built over the last two decades.

The combined annual revenue of current incumbents is this market is estimated around $1.5 to $3 billion annually. A major chunk of this revenue is generated from after sales services and maintenance.

Exponential increase in digital payments over the last decade, ever changing regulations and fintech reinventing business models are some of the reasons that this market is still alive and in fact, it is poised for growth.

Facts, Risks and Opportunities

Barriers to entry are relatively high considering the nature of capabilities required and regulatory expectations along with very traditional sales driven approach.

Corporate payments processing market, over the last decade has become complicated, too many players practically offering the same value with similar price points and in most cases, the relationship between executives proves to be the differentiator. This is a sign of an industry that is moving in circles, eventually the gradual loss of inertia will bring it to a stop, unless enough external force is introduced to get it out of the loop on to an onwards path.

Competition includes large legacy software vendors, along with regional tactical players, and then there is the push to build things in house for financial organization.

An obvious question though is, is there even a market left to cater? Well regulators, fintech and customer expectations have made sure that this market is like a tree that sheds every few years and grows in the process. The key would be to find small segments in the payments market that have relatively lower competition, for example processing transactions with regulated digital currencies, and build a customer base on the back of that value.

So, yes there is big enough market, but entry for a new player would be difficult if the traditional business model is leveraged, as followed by the incumbents.

Regulations create few of the most important opportunities in this market, but they are slow as a snail. A new instant payment scheme can take anything between 2 to 3 years from the time they are announced, and even then, the infrastructure is implemented in multiple phases, which can take multiple months or even years to complete.

Building a strategy around this can be highly unpredictable, taking up precious resource.

Market size is huge, in theory. Every financial institution, large corporation, fintech with access to more than a few million transactions a month would absolutely need a “Payment processor” to manage and settle these payment transactions. Every region, MEA, Asia Pacific, LATAM, Europe, Americas, all have similar needs with some critical variation.

Capturing only a 10% market could result in a business with annual recurring revenue of somewhere around $500 million. The question is how to capture this 10% market.

Business model innovation is one major reason that the payments industry is growing. Open banking standards, and BaaS framework are proving to be essential for success, even though they introduce both uncertainty and opportunities in the equation.

Customer expectations and the rise of fintech in this market are interlinked, so “Payment Processors” need to focus on the end consumer (customer’s customer) as much on their immediate customer, if not more.

Proposed Strategy

Peter Thiel, one of the founders of the payments giant PayPal, in his book “Zero to One”, suggests that an good strategy for a startup is to find a market with low or no competition, possibly create a new segment, building a monopoly and sustaining it for as long as possible. Corporate payments processing is a market with high competition, in fact it has huge competition from players who have deep pockets and thousands for resources.

In any case the objective must be to build a monopoly in a market or industry that you choose, and sustain it for as long as possible, anything less will not do.

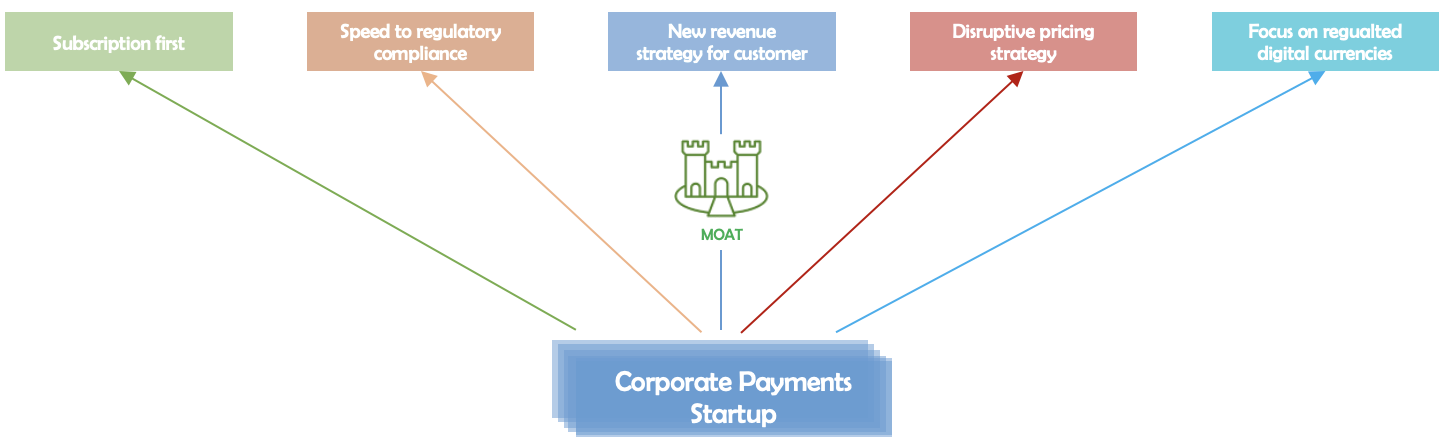

Step one, build the “moat “.

- Find product and services distinction, with regards to capabilities, pricing, and delivery of the services.

- Build for the customer’s customer. Certified APIs with proven use cases that have potential to generate revenue for the startup’s customers. Possibly find a way to monetize this and offer subscription cost, license for core services on discounts or even free.

- Long term innovation strategy: Keep an eye on the market, build and innovate fast.

Step two, find “THE” customer segment and build a razor-sharp focus on it.

- Banks with a relatively lower assets under management are not the focus for most incumbents, everyone under around 20 billion to few $100 million in assets.

- Large corporations with nonstandard needs, and payment fintech who usually have to world with many FI’s to process payments. These are usually not the focus in this market.

Step three, build a distribution strategy.

Partner with the behemoths in each segment, per country. “Hunt distribution and not isolated customers.” Find the smallest piece that can be sold to build a large customer base, then cross sell to grown revenue, relationships are huge in this business.

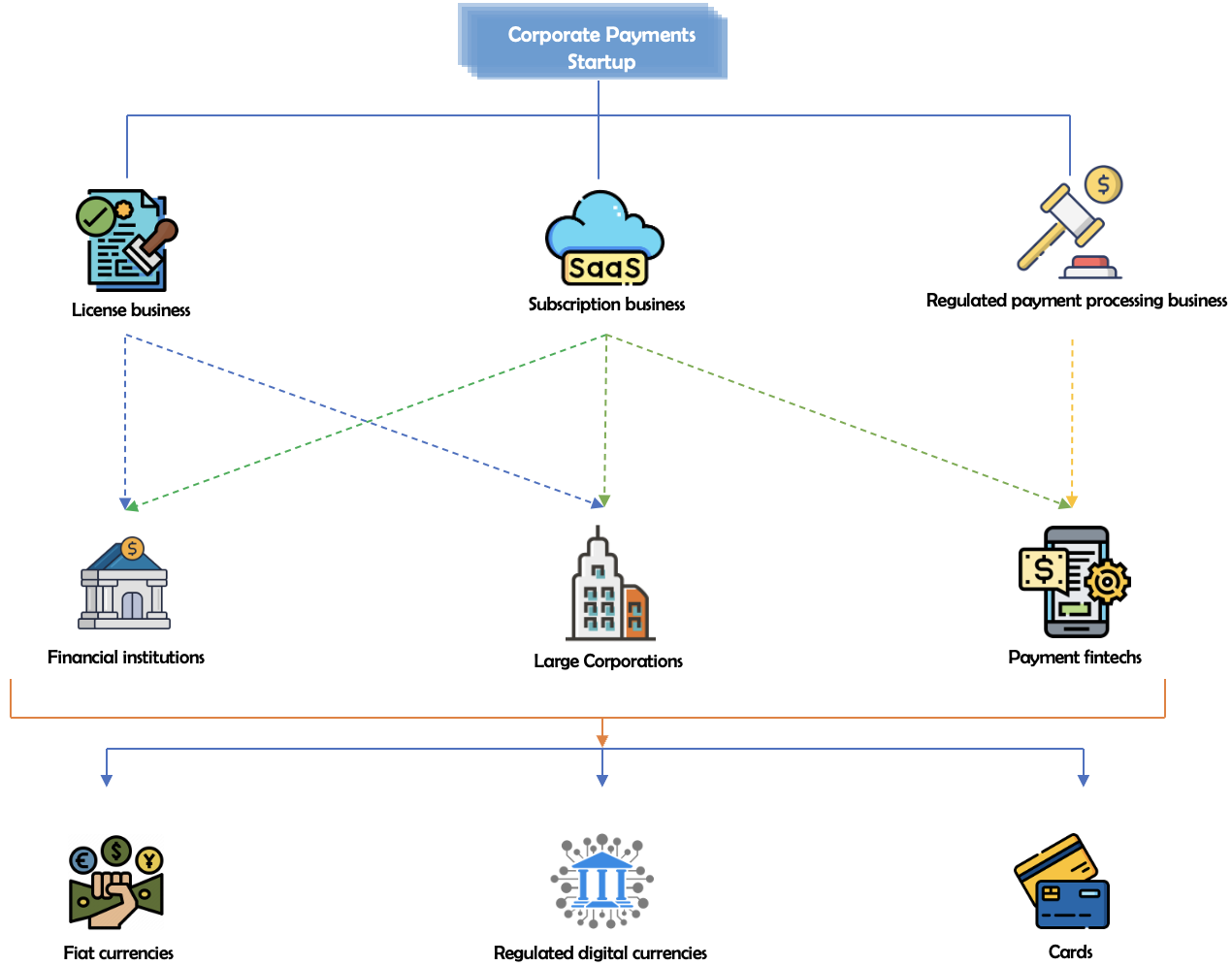

Eventually, scale up and grow revenue with help from private equity. Collaborating with the right “Private Equity” firm early on in the startup’s journey could prove to be a catalyst, giving access to partnerships and larger customer base.

Collaborating with a private equity organization could also prove to be a hinderance to the innovation as well, but in a market which is perceived as crowded, support from a larger organization can prove to be a catalyst.

Execution approach

It is critical to a high-level view of the three fundamental questions when building a business strategy. If these questions are clearly answered at an early stage,

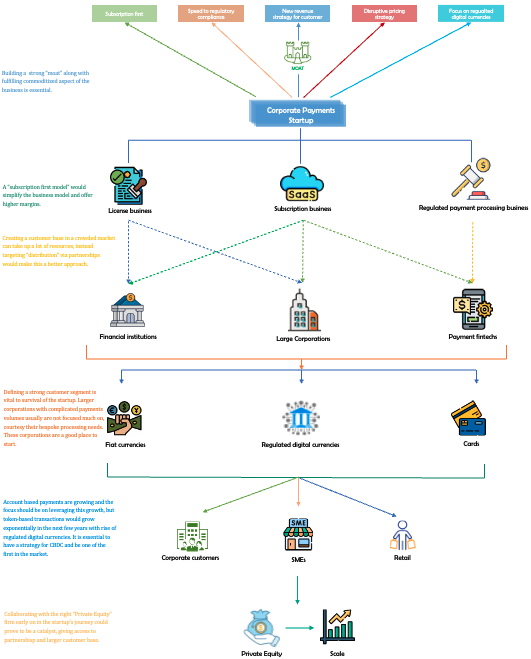

- What products and services would be sold?

Defining basic products, services, and value proposition.

- Who would the products and services be sold to?

Defining initial customer segments.

- How would the product and services be sold?

Defining tactical execution along with standards and processes.

What products and services would be sold?

The competition is intense, and the options for an organization (financial institutions, large corporations, fintech) in need of a corporate payments’ processor are many. In a market with these attributes defining a unique value proposition/moat that would sustain for a while is essential to even qualify to be positioned in the market. Most of the current offerings by incumbents differ slightly in some attributes, around cost and some technical capabilities, but most of these are essentially the same offerings.

The below list is not exhaustive, but it does summarize fundamental attributes of the current offerings being positioned for financial institutions and large organizations,

- Legacy product approach, functionality and technology used to run these complicated systems.

- Long implementation/onboarding cycle, irrespective of the license or SaaS models.

- Long regulatory compliance cycle, think new clearing schemes.

- High costs of the product or service, and even higher total cost of ownership.

- High cost of perpetual changes driven by regulations, business needs and major shifts every 5 years.

- High cost of resources and peripheral integration.

- Almost zero focus on business innovation which may lead to new revenue.

- Comprehensive set of capabilities.

- Credibility and experience acquired over the years.

- Relationship with regulators.

- Deep pockets and huge resource base.

This list offers a great starting point in building a “moat”, but catering to the fundamentals is critical.

Fulfilling fundamental needs

Initiating and processing payment transactions till settlement is a necessity for any business, more so if the business is a financial institution. Leveraging the financial infrastructure provided by central banks (for example, clearing and settlement systems). Complying to regulatory mandate, especially for financial institutions is of utmost importance, not complying could mean penalties or worse loosing customer trust.

Running operations efficiently is also important, else the business would most likely leak revenue, and may not reach when it was supposed to reach. Operations is a very vague term, and can represent a wide array of activities, but the below point mostly form the core skeleton of a good operations engine.

High efficiency with a clearly laid out time bound path for execution of all services leveraging standards and policies, transparency and visibility with data and analytics that can help stakeholders make important decision, robust performance with focus on speed and reliability and secure environment that can be trusted with mission critical data and systems.

Business innovations with a focus on building applications either internally or in collaboration with partners to create value, can prove to be a differentiator. Leveraging the regulations while complying to them to generate new revenue can give the business an edge in a very crowded market.

For example, differentiating APIs powering clear and precise use cases for a financial institution’s customers could mean an increase in size of the FI’s customer base.

Beyond the fundamental, commoditized capabilities, is where an opportunity to build a differentiating moat lies.

Build the “moat”

Google defines moat as a wide dench surrounding a castle, protecting it. In the startup industry moat is a popular term, but probably not practiced and focused a lot on.

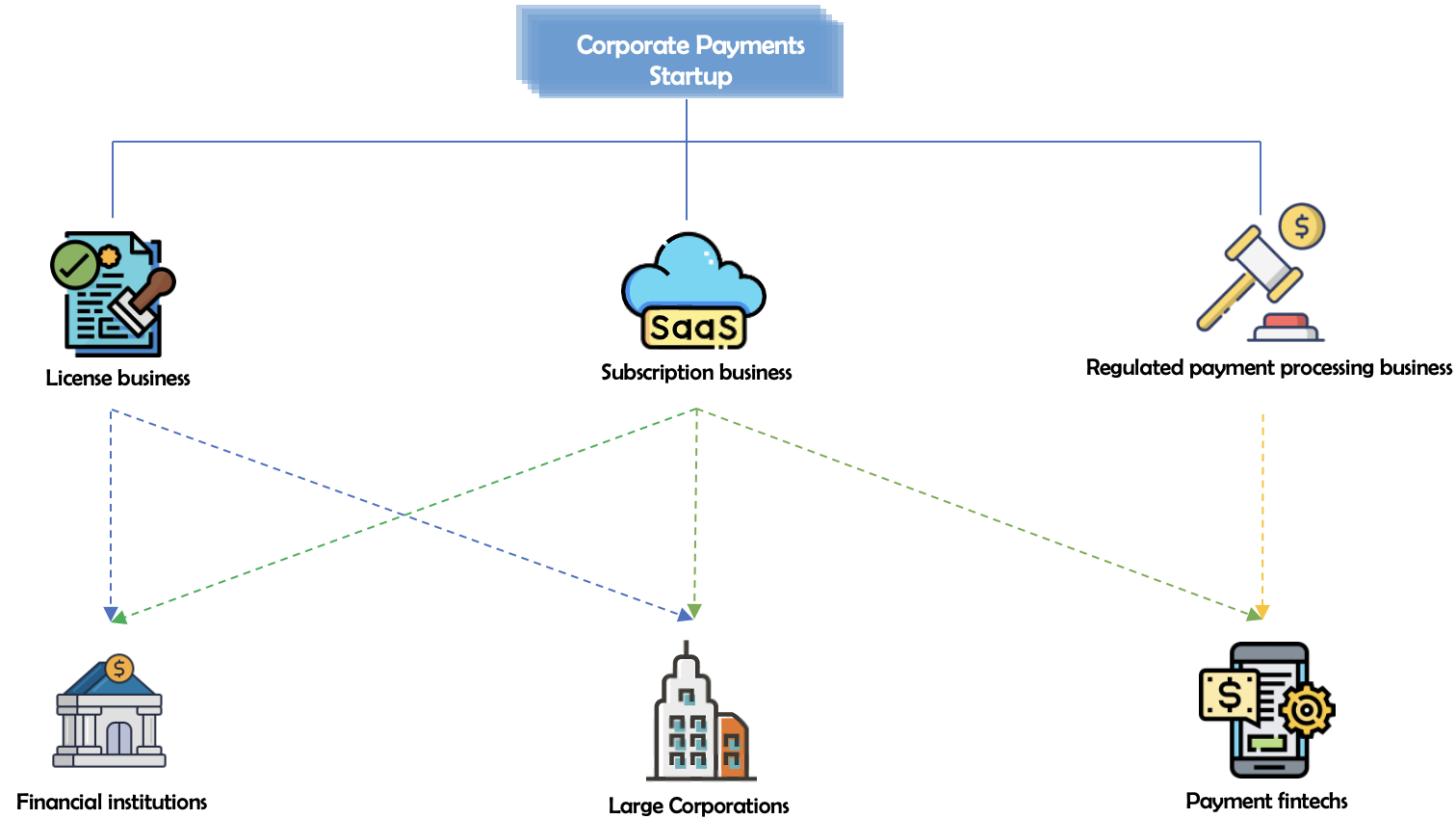

The image above describes a “few” key aspects that should be considered while building the strategy, but an iterative approach to finding the right path is considered more appropriate.

Moat usually is not one thing, but a combination of many right attributes, for example selling a SaaS processing services for free to tier 4 banks in Saudi and instead generating revenue from the new possible business generated from the APIs offered along with the SaaS service.

Who would the products and services be sold to?

Financial institutions would always be a strong customer base for transaction processing business. But traditionally regional and local banks are usually not catered very well, large banks though have had a lot of attention already.

Large corporations are a very underserved segment, even when compared to smaller banks. Corporates in the telecom, automotive, and any multinational industries are usually processing huge transaction volumes, which are today executed via complicated systems. These systems are expensive and inefficient.

Large corporations should be considered as the priority for a corporate processing business.

Payment fintech are growing across the globe, and so is the transaction volume they acquire and process. A business model as a “regulated payment processor” connecting various settlement networks via financial institutions could prove to be a tremendous revenue generator.

Building a processing business for large corporations, while catering to smaller banks, regionally or in a country.

A processor for Fintech payments should be built as a business over time leveraging revenue from the other two segments.

How would the products and services be sold?

Building a traditional pipeline-based sales model, hunting for individual customers, may not be the most appropriate approach in this market.

An appropriate approach would be to hunt for distribution networks via collaborations and offering deals that collaborators cannot refuse and putting money on table if needed.

Find collaborators who have strong customer base in of the segments that the startup wants to cater to and build a model that works for both. For example, independent services providers in each country would usually have a strong customer base of banks, if done right, leveraging these ISV’s would catapult the startup to a larger customer base in a relatively shorter time.

Conclusion

Corporate payments market is a crowded market that sheds its skin every few years. A startup with ambitions to build a business in this market, an appropriate strategy must have these two elements –

- One, a framework to build a strong “moat” which is adapted to the industry consistently over long period.

- Two, a focus on building capabilities with an objective of generating revenue for the end consumer (customer’s customer).

If the strategy is built with an objective to add tangible value to customer’s business and impacting revenue, this intent could possibly lead to a sustainable business.