The size of the airlines industry is estimated to be around to $850 billion in 2023, according to a report by Statista. It is an essential industry for the world to function, highly competitive in both low cost and full services segments, along with being highly commoditized and regulated. Irrespective of all these constraints, the airlines industry is expected to grow, either through consolidation of airlines or emergence of new players, nevertheless both these events are expected to occur simultaneously.

The airlines industry is a low margin business and “flying” services per say is a loss-making unit, but interestingly frequent flyer programs, FFP, of most airlines are valued much higher than the airlines itself. A good example of this is Delta, according to a legal filing in 2019, the American airline Delta was valued at $10 billion and its frequent flyers program was valued at close to $22 billion.

The financial technology aspect of the business offers a great opportunity for rebuilding the fundamentals, and fintech firms are probably positioned much better to offer products and services aimed at creating a business around this industry.

This document describes an approach which was built for a fintech operating in MENA who intends to build a proposition for the airlines industry, leveraging open banking regulations and Banking as a Service frameworks, with the objective to impact the “outcome” for both the airlines and their consumers.

Observations; Facts, Opportunities and Risks

Facts

The global airlines industry runs with about 5000 airlines officially registered and about 1200 actively running operations across domestic, regional, and international borders flying billions of people every year.

Airlines industry is an essential industry for the global economy to function properly and has been in existence for about 100 years. The result is great streamlined operations along with legacy technology and saturated revenue pools with high competition. The airlines business is very frequently impacted by industry shocks such as price shocks generated by oil prices, labor costs etc. Demand shocks also makes big impact on the business, such as a global pandemic, geopolitical events, which can lead to additional cost cycle of hiring, training, laying off and rehiring.

The airlines business, based on business model approach is segmented in two major categories, “full service” and “low cost” airlines. Deregulation and Consolidation in the 1970s led to the frequent flyer programs, and this has become one of the most essential aspects of the airlines business, so essential that in many cases the frequent flyer program is valued more than the airline.

It is said that, flying business per say is a loss-making business. In the American airlines industry, “Revenue Per Available Seat Mile” is considered close -0.4 cent, and in this scenario frequent flyer programs make up for much of the operational profitability for the airlines.

FFP programs of most airlines are much more valuable than the airlines itself. American airlines, Delta in 2019, its frequent flyers program was valued at $25 billion and the airlines itself at $10 billion.

Frequent flyer programs enable airlines to operate somewhat like a central bank, they control the currency in form of miles or point. These points are sold to issuing credit card banks and the banks then distribute to consumers through their financial instruments, but the airlines still decides where and on what these points can be spent on. The exchange value of miles is somewhat perception based and may be impacted by the airlines and only the airlines have the power to convert miles into real cash. The entire value chain of airlines loyalty accumulation and redemption of miles/points, via the issuing banks is a source of major revenue generation for the airlines where they have an upper hand as much less airlines and larger number of banks willing to gain the business form these large accounts.

Opportunities

A very peculiar attribute of the industry is that, like a fintech or an established organization, airlines still are just seen as an option by most consumers. Usually, airlines do not have a way to measure their customer base. In fact, ironically, the loyalty program does work to an extent, but it is still difficult to keep customer with one airline.

If an attempt is made by the airlines to start building a portion of this customer base to monetize it, along with brining some key aspects of the fintech value chain inhouse, this approach could unlock new opportunities in terms of revenue generation and cost savings.

Two examples of organizations solving the “identifying and monetizing” the consumer base problem in a highly competitive and commoditized market are Starbucks with a native application and Amazon with its “prime” paid membership, both are great reference points to consider. Apple with its ecosystem stands out as a case study, adding value to its measurable customer base.

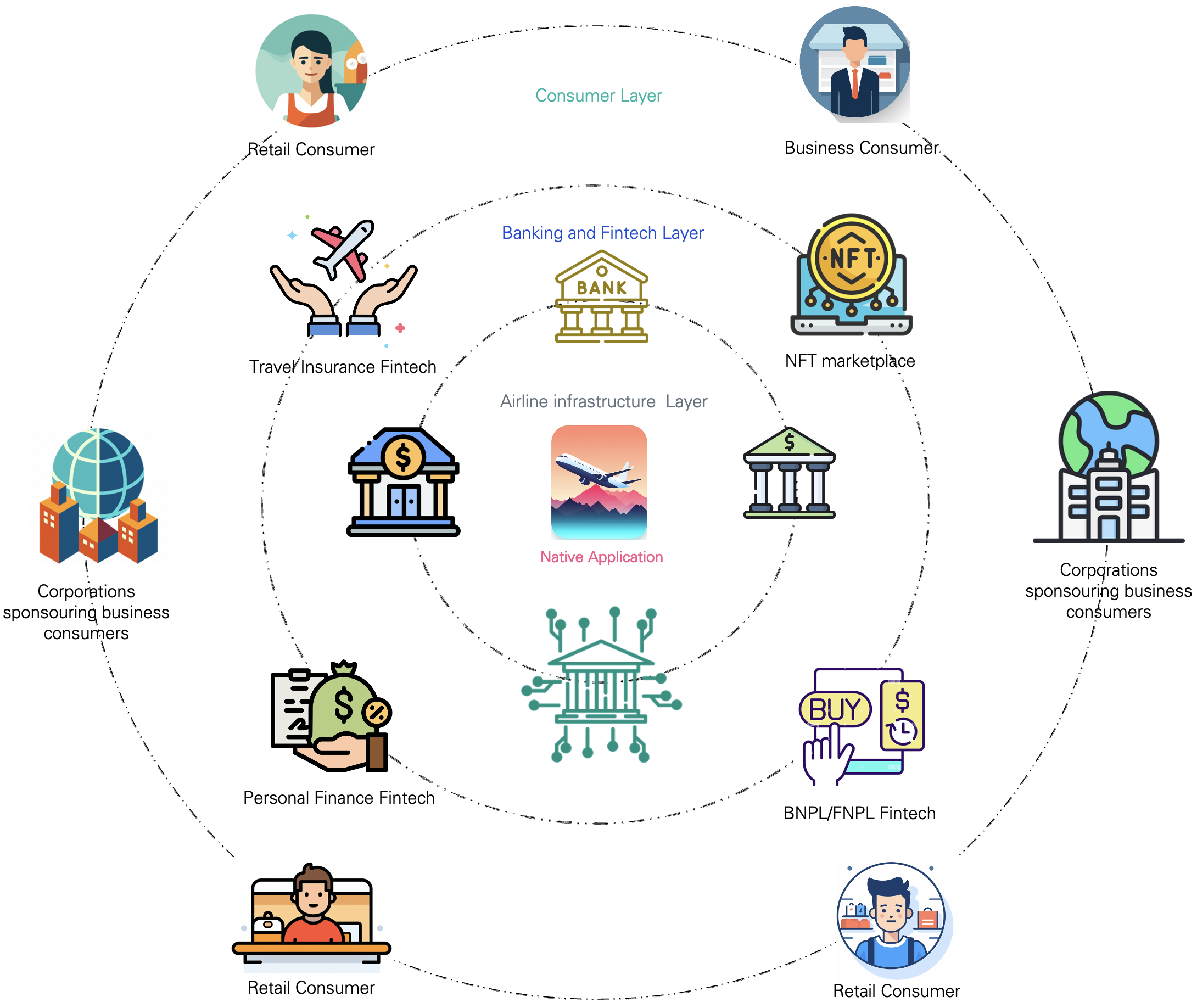

In this case, the ecosystem may include stakeholders like corporates sponsoring business travel, domestic and regional wallets as alternate to issuing banks, global payments processors as alternates payment methods, fintech offering service as BNPL, and an extended Ecosystem of partners where points can be redeemed.

For a Fintech, packaging these product and services together as offerings to the airlines industry could prove to be a tool to breaking new grounds in a traditional industry which has been experiencing much friction both from the perspective of the consumers and the airlines.

Risks

Most of possibilities described above would need a change in consumer behavior, and changing consumers behavior is an uphill task in any industry. This increases the risk of a lower adoption by consumers, which can derail the entire approach.

Any new model has to tap into the one the most tangible revenue generation pool that the airlines command, the frequent flyer program, and this creates a real risk of cannibalizing into existing FFP revenue, so caution is advised.

Regulators also pose a major challenge, as the opportunities are to explore financial tech in the airlines business, the regulators could just put their foot down and create essentially unbreakable barriers to entry.

Competition and consolidation in the airlines industry will assure that any sort of edge or monopoly will be lost over a period of time. In the context of remodeling financial technology and generating new revenue, most airlines would have 3 years unless they innovate consistently before being replicated.

Proposed Strategy

The Hypothesis

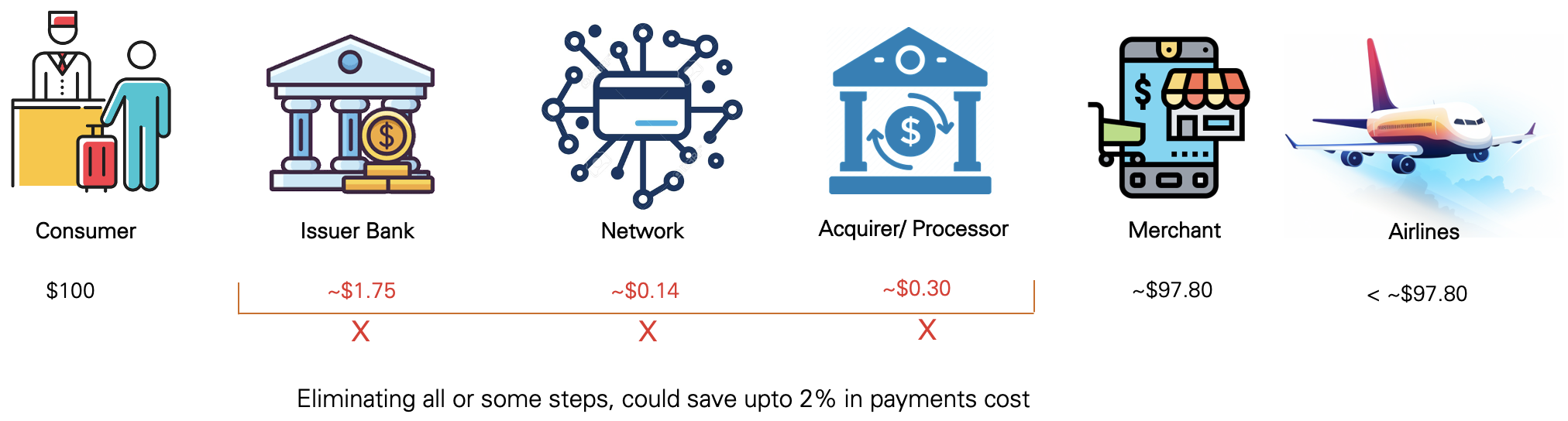

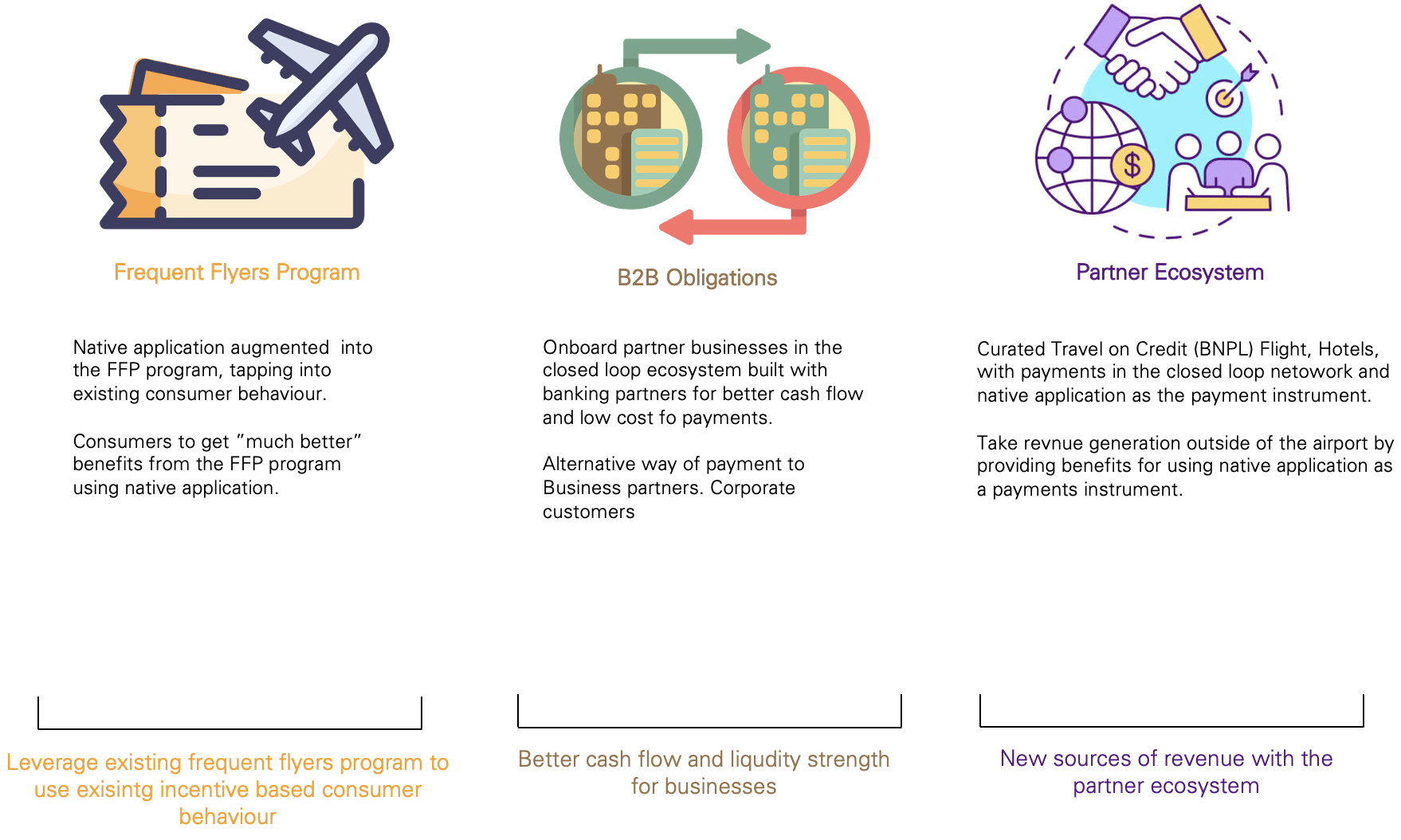

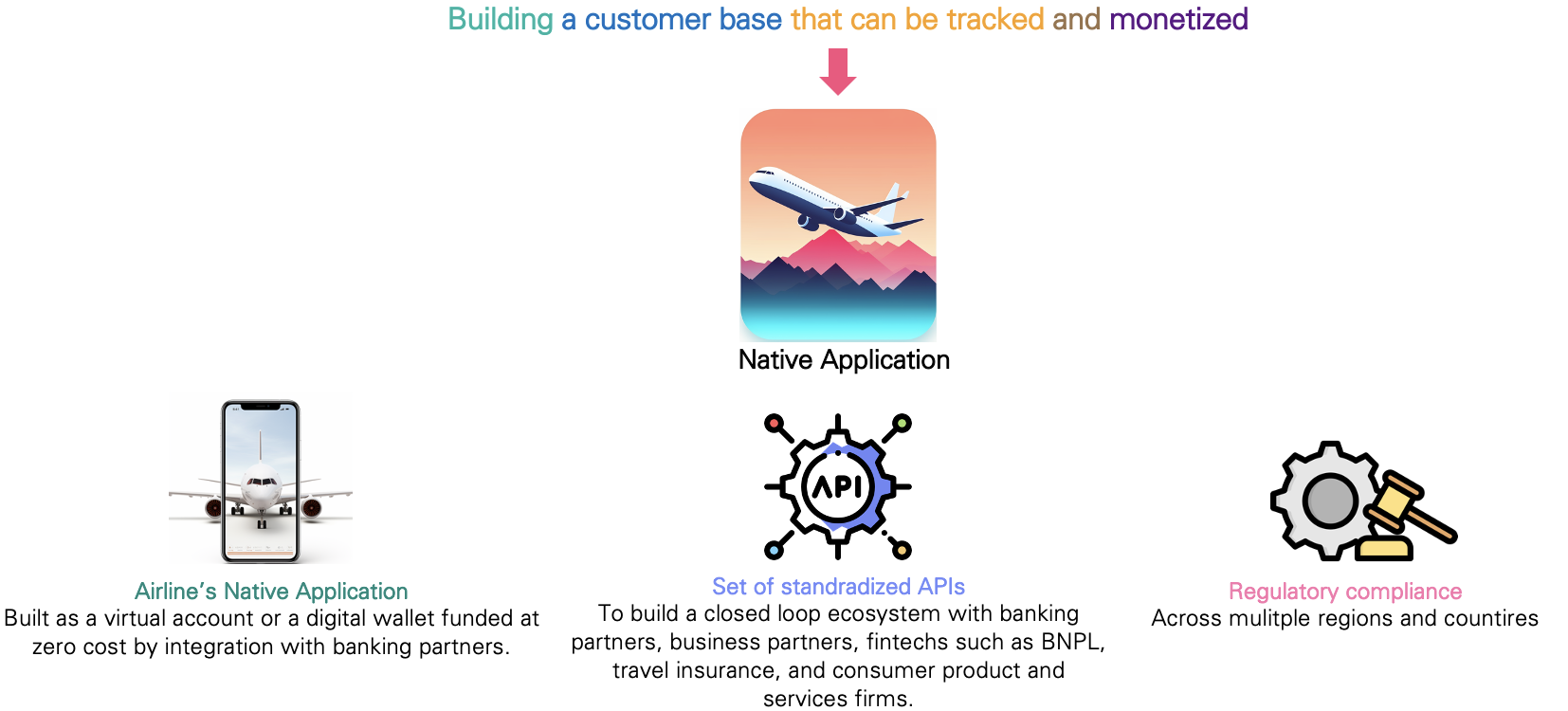

A fintech could make an impact on the airlines industry by focusing on creating propositions to aid an airline to build a measurable customer base that can be monetized via an extended partner ecosystem and building solutions to bring some part of the banking technology inhouse, including owning the store of value, instruments to make payments along with essential part of its settlement process, and the entire approach augmented into the current frequent flyers program.

The airlines industry is highly mature and has a combination of legacy and modern technology driving it. The financial technology facets of the business are still relatively legacy, more so on the enterprise side. It is an uphill task to modernize, and barrier to entry are high for a new player to make an impact in the short term.

Improving the way airlines collects and makes payments is a key aspect that can be improved, and this entire approach is relying on this single thought leading to a larger ecosystem play.

As Paolo Sironi, author of “Banks and Fintech on Platform Economies” would describe it, the aim is to improve the “outcome” for both the consumer and the airlines.

Step one – The Native Application

Build a “Native application” to retain and acquire a “measurable customer base” and to bring some or all parts of the banking technology inhouse, which is then augmented into the frequent flyers program offering “much better” benefits to this customer base.

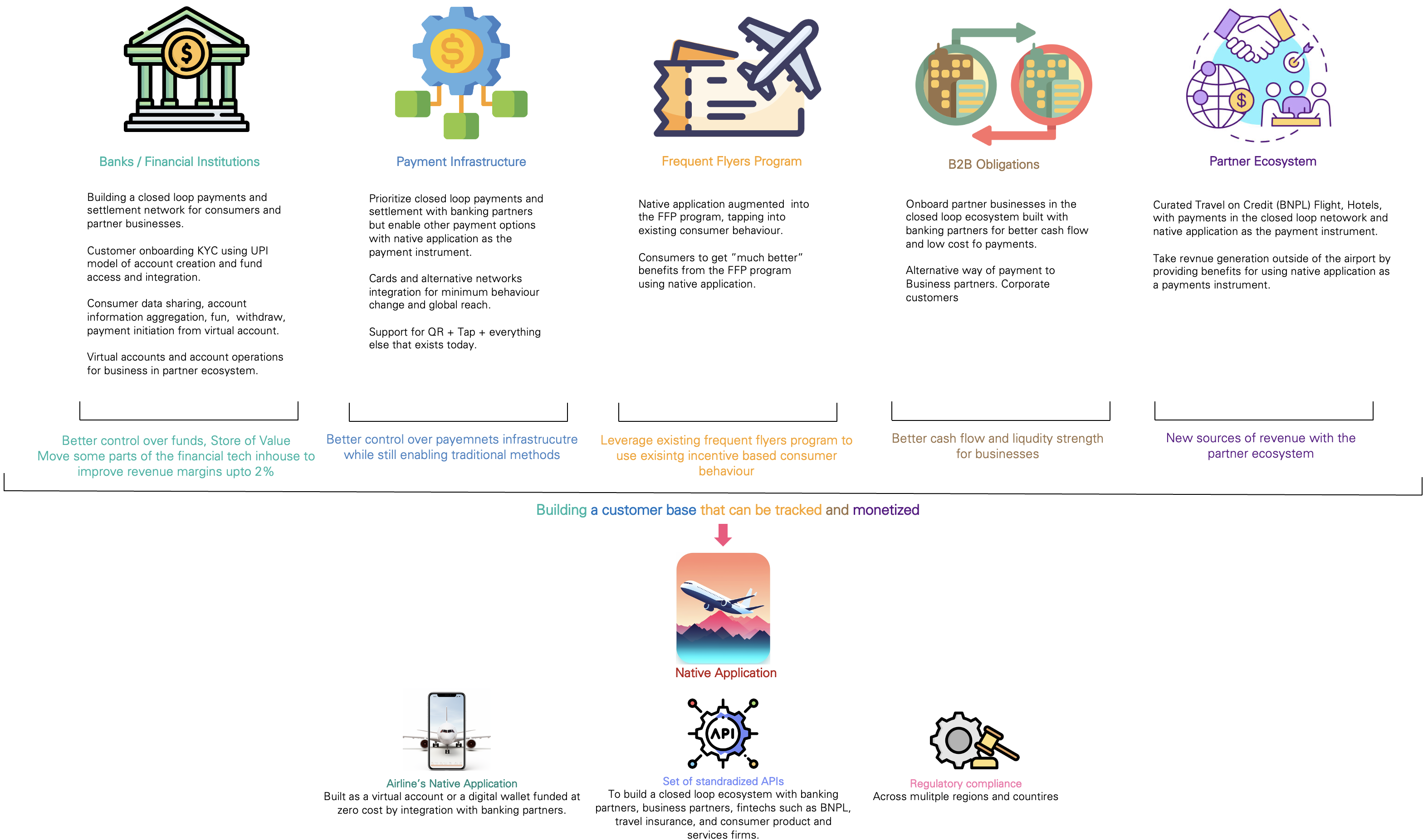

Running an airline traditionally has been a low margin business, with ever increasing pressure from regulators, competition and industry generated shocks around cost and demand. An important part of the overall cost is the cost of payments and collections. The airlines, for every $100 worth of business they do, usually pays anything from 2.5% to 3.5% in additional fee and surcharge and receives close to $97.

On a high level, there are three key aspects where this cost is concentrated; payment instruments such as cards and wallets, intermediaries such as card issuing banks and acquiring banks, and infrastructure providers such as card networks and account-to-account networks for settlement.

The objective of this “Step” is to rethink this part of the value chain from the perspective of an airlines business and building a native application. It is an approach that is worth exploring, as described in the following arguments.

Rationale for the Native Application

A native application for the airline is at the core of this entire approach, built as a store of value, in form of either a virtual account or a digital wallet and created as a robust mobile application focused on making all of this convenient for the consumer while adding more value. The application will be supported by an API layer to move information across the airline’s internal infrastructure, financial institutions and external partner ecosystem embedding product and services into the consumer experience.

The fundamental idea is that the airlines would use this to build a “measurable customer base”, one that can be tracked and be sold products and services even when they are not flying or inside the airport.

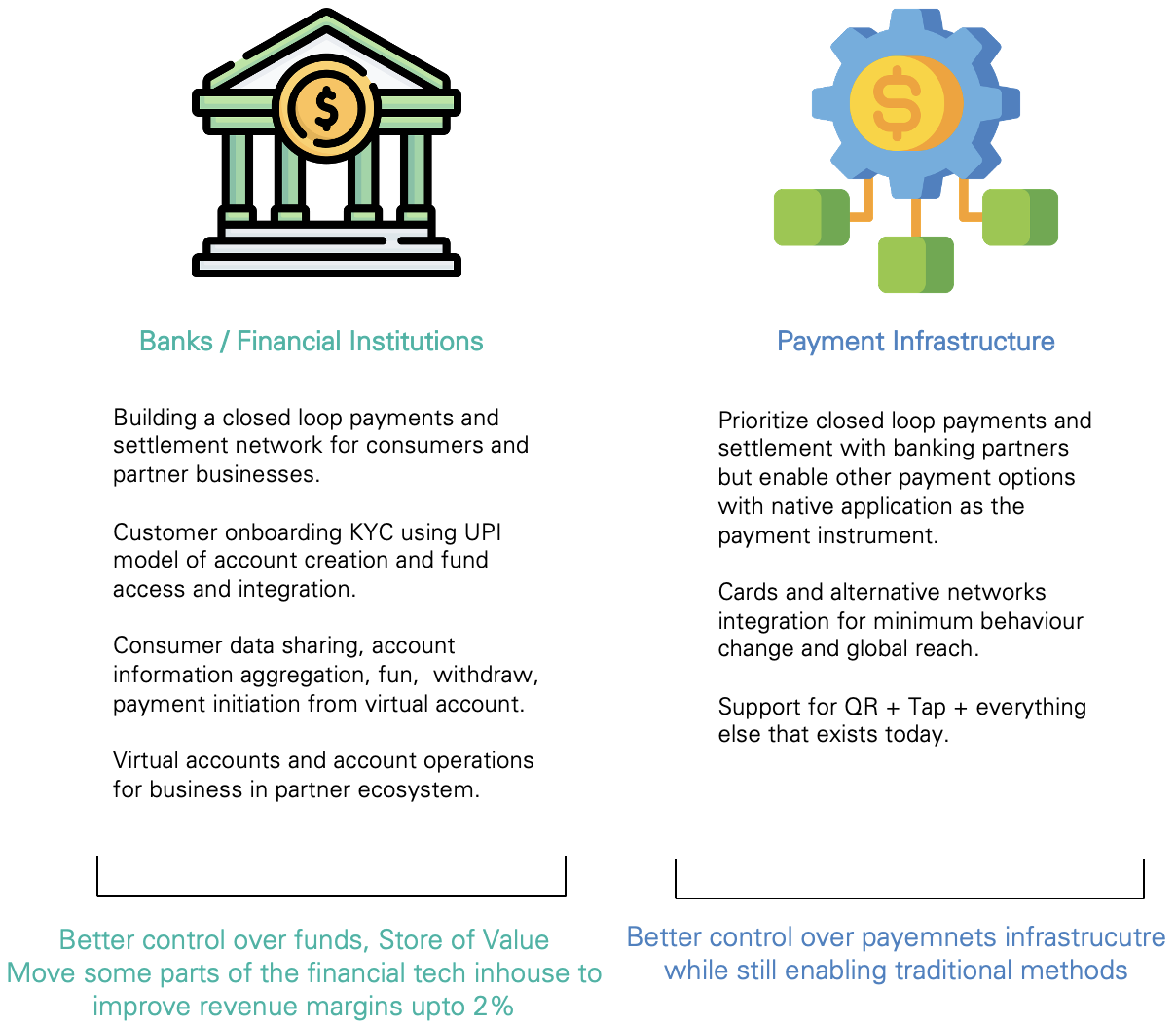

The role of Banks and Financial Institutions

The wallet or virtual account will have the capability of being funded directly through a bank account via integration with a bank using a model similar to Unified Payment Interface or UPI of India. KYC and integration with the physical account of the consumer will be done via a unique alias such as a mobile number, removing any barrier to entry for consumer to be technically onboarded on to the native application.

The integration with the bank would also allow the virtual account to be funded at zero cost and enabling the native application to be used as a payment instrument. The key consumer operations like flight ticket booking, purchasing insurance, or financing a trip with credit (BNPL/FNPL) can be done within the airline’s ecosystem preventing any fee on a payment or collection, as the store of value and major parts of payment settlement will reside with the airlines and partner banks.

The native application would also enable the consumer to make purchase in their current preferred ecosystem but with perks for using the native application instead of other instruments. The consumer will be able to use the airline’s native application outside the airline’s ecosystem, capable of in-store payments via QR or NFC/tap of any kind, and online payments minimizing the need for change in consumer behavior around paying. This capability will incur fee and surcharge to the airline, but this would still save a good 1% on the transaction and increase customer stickiness.

A strong argument can also be made for the players in the partner ecosystem to keep business accounts with the airline’s banking partner using the API infrastructure, creating a closed loop of accounts within the airline’s ecosystem, preventing further cost around B2B obligations for the airlines.

Essentially in this scenario, three types of consumers segment would exist, one, using the native application as an instrument by funding it, two, consumers using the application as a channel to buy services using other instruments but still within the ecosystem and three, consumers which buy tickets from outside this ecosystem.

The cost in case on first would be close to zero per transaction as everything would be within the closed loop, in case of the second segment it would be whatever the online processors charge, say Stripe which charges 2.9% per transaction, but as the airlines will offer a larger customer base this rate can be negotiated on and the third segment would remain isolated and would be business as usual for the airlines with no cost saving. The objective of the airlines would have to be to bring as many consumers to use the native application as a payment instrument within the ecosystem.

Payment’s infrastructure with Banks, Alternate networks, domestic wallets

Assuming that the airlines get a substantial chunk of its customer base to the native application, then besides the option of using it as a virtual account and de-facto payment instrument, with the most benefits to consumers in terms of loyalty points, access to product and services through the partner ecosystem. It would still be important to offer other popular options to make payments, like cards and domestic and regional digital wallets.

This array of options would include alternate networks like stripe, Adyen and their processing capabilities along with traditional card networks. All this would have a cost associated with it, but it is important that the consumer has this option.

Integration into the Frequent Flyers programs

The Frequent flyers program (FFP) is the closest thing the airline has to a customer base, and it is a profitable business, in most case it stands at two or more times the valuation of the airlines itself, as mentioned earlier in case of American Delta airlines. The FFP makes the airlines seem like a central bank, with its own currency issuance in form of points/miles and its own currency distribution through the issuing banks, with only the airlines with the power to convert the points into a fiat currency. It would be bad idea to tamper with the frequent flyers program.

A better approach is to augment the native application into the FFP with offering “much better” benefits for using the application instead, in form of more points, or access to better product and services as a way to “pull” customers into the ecosystem and then “push” more services to them.

Another aspect worth exploring would be to use elements of web3 in the existing loyalty program. One example could be owning aspects of leisure trips, in form of high-quality pictures that are tokenized and issued in form of NFT, and potentially monetized for the consumer. Needless to say, this probably would need an entire research paper in itself, but for sure something the airlines should consider embedding in their experience.

The tough decision, Paid membership, and a fee of $3 a month

Jeff Bezos of Amazon once said in interview describing his strategy to turn around the newspaper company Washington Post that he had bought, went on these lines, “you can either sell small to many million customers or sell larger (ticket items) to a few customers”. This is the approach that the airlines should refer in the process of building a substantial measurable customer base the airlines should consider charging a membership fee for a certain set of services, deducted directly from the customer’s virtual account. Anything as small as $3 a month would be about $35 million a year for a customer base of a million and if curated right, this could absolutely be free cashflow and could prove to be precious in a low margin business.

Step two – Corporate businesses

Target corporate businesses who sponsor business travel via the native application and cater to airline’s B2B payments and collections obligations via the aggregated API business hub.

Focus on the true sponsors of the business travel, the corporate employer!

According to a report by PWC, business travelers represent 12% of the passengers in the airlines industry but may represent a much larger share of the profits, as much as 75% in some cases. Businesses spend about $300 billion annually on corporate travel across the world with about $60 billion spent on airlines. This is an opportunity worth exploring.

Today the businesses manage their travel through third party firms, and there is a good reason for it. These third-party organization aggregate all travel option and find the best path to travel. Airlines have usually not been able to do this or may be never intended to do this, we at Econwired think that they should.

Building a version of the native application for the sponsors of the business traveler, the corporate employers for a connected experience between the employer and the employee. In this equation, the employer will be advocating for their employee to become a paid member of the service.

This is how the financials may go, employer pays an annual fee for discounted prices on tickets, the airlines prioritize their needs and offers exclusive services. Every time an employee fly’s, the miles/points get distributed with the employer for further cost reduction or benefits.

In theory the model assures a cost saving for the employer over a longer period of time and employee gets travel benefits that can be utilized outside the airline’s ecosystem.

Catering to airlines B2B obligations through an aggregated API business hub offering

Cost, speed, and transparency while making payments (and collections), are three key problems around payments that airlines would face, much like any other major business segment.

The objective is to build an API business hub aggregating payments option of various types for various needs for the airlines business. Salary, trade receivables, trade payables, tax, fundraising etc. and much more. On a high level, this can be divided into three parts, store of value, financial instructions, and payment settlement.

Reusing the concept that was described in “Step one”, a closed loop of businesses in the airline’s ecosystem with integration APIs, connected to each other with help partner banks or a financial institution. All business in the ecosystem would have a virtual account, that can be funded and transferred from, and for the business this operation would have a minor cost and the APIs would help make the integration relatively easier. The result would be “most” of the businesses in the ecosystem can be brought into this loop, and those who cannot be included will represent a smaller portion.

Financial instructions would be through the virtual account within the closed loop, so cost, speed and transparency of payments remains competitive, and finally the settlement of these payment to the physical accounts of these businesses would be facilitated with help of the parting banks and financial institution in the ecosystem by traditional means either end of day or as needed, this part would incur a cost to the businesses.

This approach would not eliminate the entire cost of payments and collection but would reduce it to a substantial level.

The result would be that for businesses, most of the operations amongst the closed loop ecosystem, cash flow and liquidity strength would improve and the cost of the of payments and collections would reduce. If done right this would mean better margins and cash flow for the airlines business.

Step three – Standardize integration APIs

Build standardized APIs to “extend partner ecosystem” to offer curated products and services, to continue to generate revenue outside the airport with the native application being the default instrument of payment across the ecosystem.

Revenue generation beyond the flights and traditional Frequent flyers program is important for a positive impact on the airline’s top line. The revenue generation approach outside of the airport can be build leveraging an extended partner ecosystem, stitched together using integration APIs to induct various types of businesses.

The airline should build the native application as universal as possible, and reward using the native application as a payments instrument. Building curated products and services with partners in the ecosystem to improve core product of the airlines, “air travel” as an outcome for the consumers and airlines.

Offering these curated experiences, or air travel in general though the native application on credit using features like BNPL (Buy now pay later) or more aptly named, FNPL (Fly now pay later) can create a strong pull mechanism for the customers. Interestingly this can also keep the customers on the application and help push more such services.

Payments and collection between all players within the closed loop ecosystem settled through banking partners.

The partners in the ecosystem, such as BNPL, travel insurance, hotel, travel websites, luxury consumers goods inducted through seamless API integration, essentially receiving three fundamental benefits, 1) Offering customer data insight to these partners through the native application, resulting in a more relevant “Push” of products and services to the consumers 2) Enabling their consumers to pay for the product and services through the virtual accounts, either in full or FNPL partners 3) Aggregating financial information for the consumer to make decisions in the long term, like saving for a trip or a luxury product.

A very popular segment and “pull” mechanism for customers is digital assets and currencies, the idea of owning a piece of their experience and monetizing it is pretty attractive. For example, some high-quality pictures taken on trips through the application, can be published as NFTs (non-fungible tokens) with partnership with platforms like OpenSea, which is an NFT marketplace.

The experience of owning an NFT and possibility of making money of it is a good first step towards a tokenized world for the airlines. Needless to say, the revenue realization for the airlines in the ecosystem would be through sale of tickets but also revenue share with the partners and augmenting the ecosystem in the frequent flyers program (FFP) by selling miles/or airline points to these partners, similar to what the airlines would do for the card issuing banks today.

The native application, curated services, airlines miles/points, cashbacks and other perks would be essential in “pulling” customers to the native application and incentivizing to use it.

Today one of the most successful payment applications is probably in Apple Pay. It offers convenience in the ecosystem and outside it, taking reference here, the airline’s native application, can potentially offer convenience and money (in form of perks) to use it within the extended ecosystem.

Transparent communication across the ecosystem would be essential to implement this model, but once implemented, it has the potential to open new avenues of cost saving and revenue generation for the airlines.

Strategy Execution Approach

It would be critical to have a high-level view of the following fundamental questions while building a corporate and business strategy to execute the approach described in this document,

- What products and services would be sold? Defining basic products, services, and value proposition.

2. Who would the products and services be sold to? Defining initial customer segments.

3. How would the product and services be sold? Defining tactical execution along with standards and processes.

The following sections describes “a” way in which these essential questions can be answered, having said that, usually multiple ways exist to reach a desired destination.

What products and services would be sold?

Defining basic products, services, and value proposition.

The core value proposition would be based across three key aspects, “One”, the native application and closed loop API integrating into partner banks and the airline’s internal infrastructure including the frequent flyer program. “Second”, a set of Standardized APIs to build, operate and manage the airline’s “extended partner ecosystem”. “Third” regulatory compliance advisory either embedded as part of the offered products and services or as a sperate service.

Native Application with closed loop integration with Banks and Financial institutions.

Controlling the store of value is essential for the airlines, a path would have to be chosen for either using a virtual account mechanism, or a digital wallet. Sounds simple, but this is the nail that would hold everything else together.

Integration with domestic and regional banks along with financial institutions, fintech offering other key services such as credit as BNPL/FNPL and travel insurance. Another key aspect of integration would be augmentation of the application in the frequent flyers program of the airlines.

The native application would offer the following key features;

* Customer onboarding and KYC via a mobile number (or similar alias) as in a UPI (India) model including capability for consumers to consent for data sharing with their banks in accordance with local open banking regulations.

* Funding of the virtual account, to be used in and outside of the airline’s ecosystem.

* Transfer of funds to physical accounts, from the application. The application can be used for requesting payments money from peers in certain geographies that allow services like request to pay which can be sent to the consumers physical account.

* Account information aggregation from various physical accounts and credit cards, to offer a view of consumer and corporate’s personal finance. Derivation towards curated services in the ecosystem would leverage this information.

* Payment initiation within the closed loop airlines ecosystem and outside it through traditional channels such as QR or any kind, tap/NFC etc.

In case of the closed loop settlement, there would be almost zero surcharge on the transaction, in case of a payment outside the loop, as the application is being used an instrument, the surcharge is relatively lower, but incase other instruments, like a card is used via the application the fee and surcharge would be higher, but sill help consumer to build habits with the application.

* Essential overlay services via integrations supported by standard APIs with fintech partners embedded into the application to use credit as a BNPL/FNPL service and travel insurance services.

A set of Standardized APIs to build, operate and manage the airline’s “extended partner ecosystem”.

The objective would be building standardized APIs for any kind of integration within the native application.

Now that’s a big ambition considering the variation that exist today in the messaging standards, protocols and more, nevertheless, the objective is to have these APIs flexible enough to accommodate an array of banks/partners/airlines, to support the fintech in its ambitions to scale.

Even with a strict approach focusing on reusability, there would be bespoke needs for integration and in these cases, the suggestion is to accept anything that has the potential to be a general or a common need and walk away from anything that is truly bespoke.

The below section describes a “four” key set of APIs to build the initial iteration of the airline’s ecosystem;

* APIs for onboarding banking partners.

- API for seamless KYC and connecting to consumers physical account via mobile number/alias.

- API to fund native application.

- API to withdraw and transfer fund to physical account, domestic and international.

- API to retrieve consumer account information.

- API for payment initiation

* APIs for onboarding fintech(s) providing essential overlay services.

- API to offer credit services via BNPL fintech within the native application.

- API to offer travel insurance via other fintech within the native application.

* APIs for onboarding airline’s enterprise services including the frequent flyers program.

* APIs for onboarding partners in the ecosystem and exposing native application services described in the above points and consuming their service in the ecosystem.

This is not an exhaustive list of course but presents a base to start. Consuming the right services from the partner ecosystem and offering in a seamless and convenient way to the airline’s customer base is the key to growth of the airline’s ecosystem and its revenue from it.

Regulatory compliance advisory

Regulatory compliance is essential for this entire approach to be successful. Everything from licenses for the native application across countries of interest, integrations in line with domestic open banking regulations to integrated into the banks, compliance to BNPL guidelines and payments processing.

The fintech should package the proposition with everything that is needed for a fundamental infrastructure per country, including licensing, financial reporting, API compliance etc. and any sort of expansion in a new country, should be additional cost.

Fintech’s relationships with the regulators and experience navigating this usually very difficult terrane could prove to the biggest MOAT along with the tech and business model.

Who would the products and services be sold to?

Defining initial customer segments.

* Airlines industry across emerging markets should be the top priority, as they usually have access to fresh funding and a pressing need to find an edge. Middle, East, Africa and Asia Pacific do stand out with huge growth in the number of new airlines.

* Global low-cost airlines should be priority two. These are a corporation pressing hard under very low margins, offering them an established model proved with airlines segment in emerging markets.

* Sections of the approach should also target fintech and partners to join into the ecosystem, such as BNPL, Travel insurance, travel curators and booking websites, NFT ownership and marketplace.

How would the product and services be sold?

Defining tactical execution along with standards and processes.

FinTech’s pricing should be in line with large enterprise sales with options to pick and choose services included in the overall package with a minimum commitment of at least 3 to 5 years. An initial cost for the package including native application, regulatory compliance, and integrations with key players in the ecosystem should include an initial onboarding cost and then a monthly or annual for more committed customers. Additional cost for adding a new country or more partner types and any sort of regulatory advisory service.

Defining the MOAT

A combination of regional relationships with regulators and ability to navigate the space, along with a business model that taps into a customer base with an extended partners ecosystem along with much better control over the payments value chain will give the fintech an edge in the near future which can be extended as long as it keeps innovating and adding value to the ecosystem for the consumers.

Potential Commercial Impact

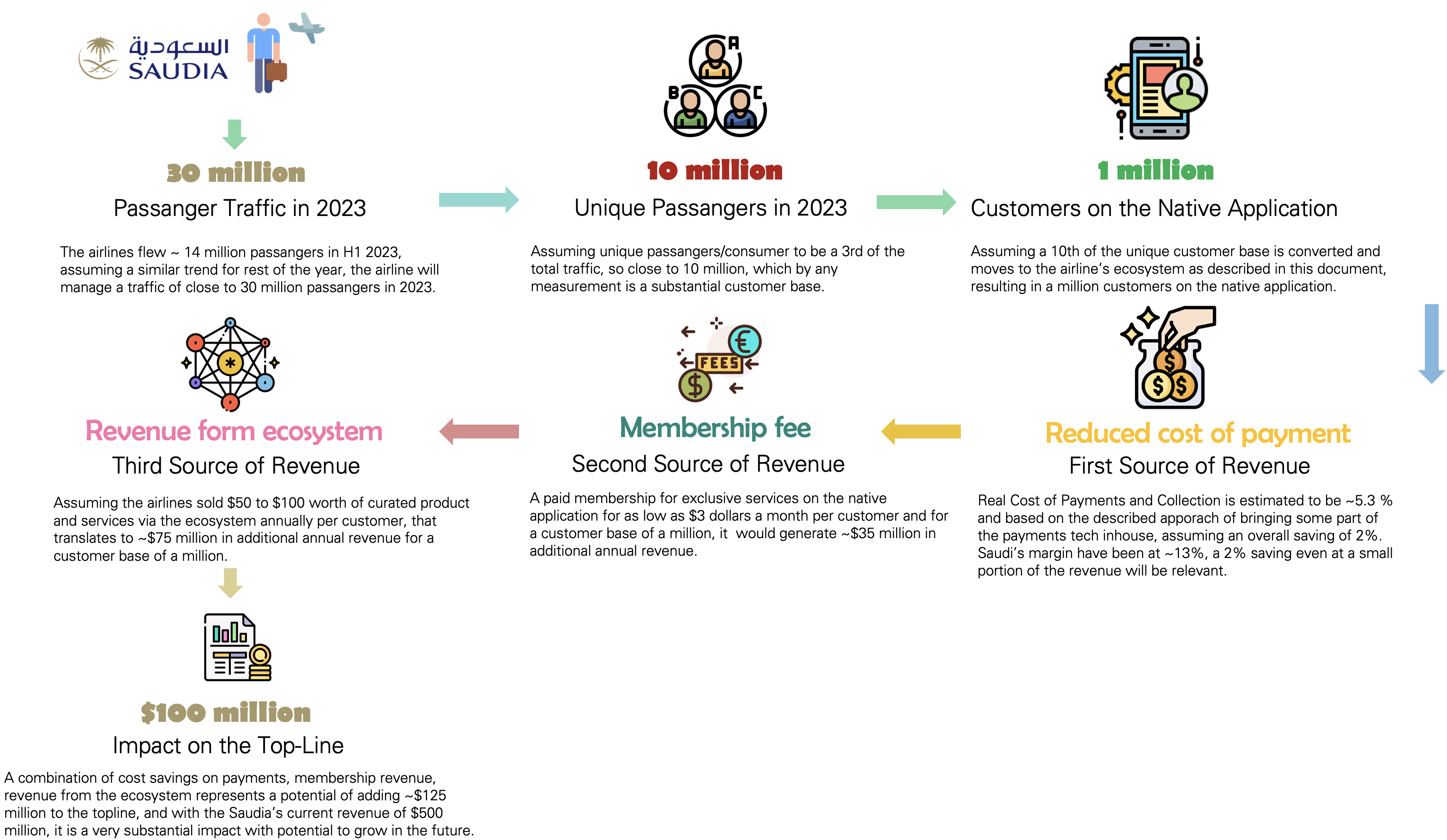

An essential aspect of revenue generation in this approach is relying on the airlines being successful in building a “measurable customer base”. Assuming the airline is successful in moving a chunk of its passenger traffic to the native application, then the revenue generations can be segmented into three parts.

One – Cost saving on payments and collections.

Two – Revenue from membership fees.

Three – Revenue from partner ecosystem.

To paint a tangible picture of the commercials, let’s consider an example of an airlines from Saudi Arabia, “SAUDIA” one of the national carriers of the Kingdom of Saudi Arabia.

It is necessary to make a few assumptions to move forward. About to 30 million passengers travel with Saudia every year, assuming a 3rd of these to be unique passengers, that’s a customer base with 10 million customers, which is substantial. Now assuming a tenth of this base is converted and moves to the native application described in this document, which makes one million customers on the application. This is a big assumption but considering all things still fair.

First aspect of revenue is via cost saving on payments. Controlling some part of the payments infrastructure is critical for long term success of this strategy, even though it represents a relatively small cost saving, a few million a year, but a blended margin of 13% for the airline, I have a feeling this will be considered relevant. The second revenue source is through the membership fee, and a small fee of $3 dollar a month can generate close to $35 million annually is pure cash flow. The third aspect is though the partner ecosystem that has been described in the document, assuming the airline is successful in selling $50 to $100 worth of products and service per year to the customer base of a million, this would represent a substantial $75 million in annual revenue.

In total the approach described in the document has the potential to add an additional $100 to $120 million to the top line of the airlines. Given that that current annual revenue of Sudia is close to $500 million, an addition of ~$120 million could be very substantial for the overall business.

Conclusion

Airlines industry is a combination of legacy and modern approaches but with a lot of friction and hence many possibilities. The approach described in this document has the potential to sow the seed for a stronger control over the flow of money in the extended airlines ecosystem. If a fintech can package these services for the right players, this does offer a great opportunity for building a business around it.