Bank for International Settlements – BIS has played an essential role in building a framework for central banks to build a central bank digital currency.

The body of work published by BIS offers suggestions that are functional, technical, and operational in their focus, but these decisions finally stay with the sovereign nations and their central banks.

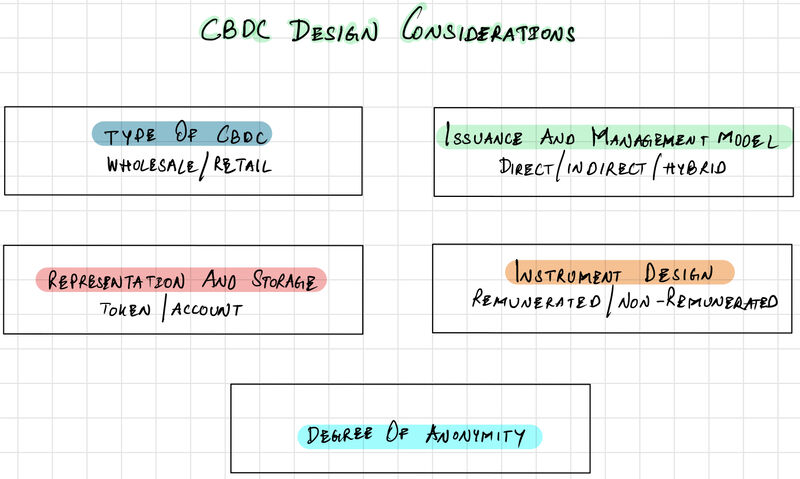

Based on the current CBDC pilots and research being conducted worldwide, central banks are considering the following design choices, but are not limited to these.

* Type of CBDC; Retail or Wholesale:

A choice that caters to different layers of the economy, retail CBDCs are designed for individuals and would basically be a digital form of the physical (fiat) currency. Wholesale CBDC will cater to the banking sector and large corporations, mostly for interbank fund movement.

* Issuance and management model; Direct, Indirect, Hybrid-

This choice refers to the allocation of responsibilities for the “issuance” of CBDC, its “distribution” and “management”. The central bank can either stay in the current model of owning the “issuance” and allocating the “distribution” to commercial banks or share the responsibilities with private financial institutions.

* Representation and storage; Account-based or Token based:

Technology will play an essential role in both the issuance and distribution of CBDC, so deciding if the currency will be stored in an account similar to traditional fiat, or as a token on a blockchain network is critical for future adoption.

This is also an important choice that would decide what role central banks will play in the tokenized economy. Today central banks have limited participation courtesy legacy methods.

* Instrument design; Remunerated, Non-remunerated:

Will the CBDC be interest-bearing? This design choice is on the extreme end of the decision spectrum. Unless the central bank wants to compete with the commercial banks, it is highly unlikely that a CBDC will be reimbursed, but you never know.

* Degree of Anonymity:

This is probably the most controversial choice, but looking at the CBDCs designed till now, it seems that CBDC will not be as anonymous as physical cash, but probably better that the current digital payment instruments. Anonymity can be based on the CBDC denominations (highly anonymous for lower value currency, but restrictions for higher value), or many other variations. In any case, central banks will have easier access to the usage data of CBDC.

There would be many more design choices, as the world normalizes the use of CBDC in domestic and international transactions and builds a more comprehensive data set.