Binance was to acquire Voyager for ~$1 billion and will open the path to unlocking customer funds. Interesting to note that Voyager was supposed to be acquired by FTX before it got bust (not suspicious at all…).

Binance does seem to be on a buying spree, that would probably strengthen their monopoly further in the #crypto ecosystem. Unless, of course, if Binance is forced to open their books and then who knows what would come out of it.

Somehow this whole idea of a really big organization controlling the #crypto ecosystem doesn’t seem right.

Amber Group, a “digital wealth management” firm which had 10% of its trading capital with FTX exchange at the time of its collapse, is raising funds and reducing workforce by 70% to protect against the backlash and current #macroeconomic circumstance.

They are raising $300 million as part of their series c, and closing retail operations and focusing on institutional and hight net worth individuals. They also plan to cut their workforce from 1000 to 300 people.

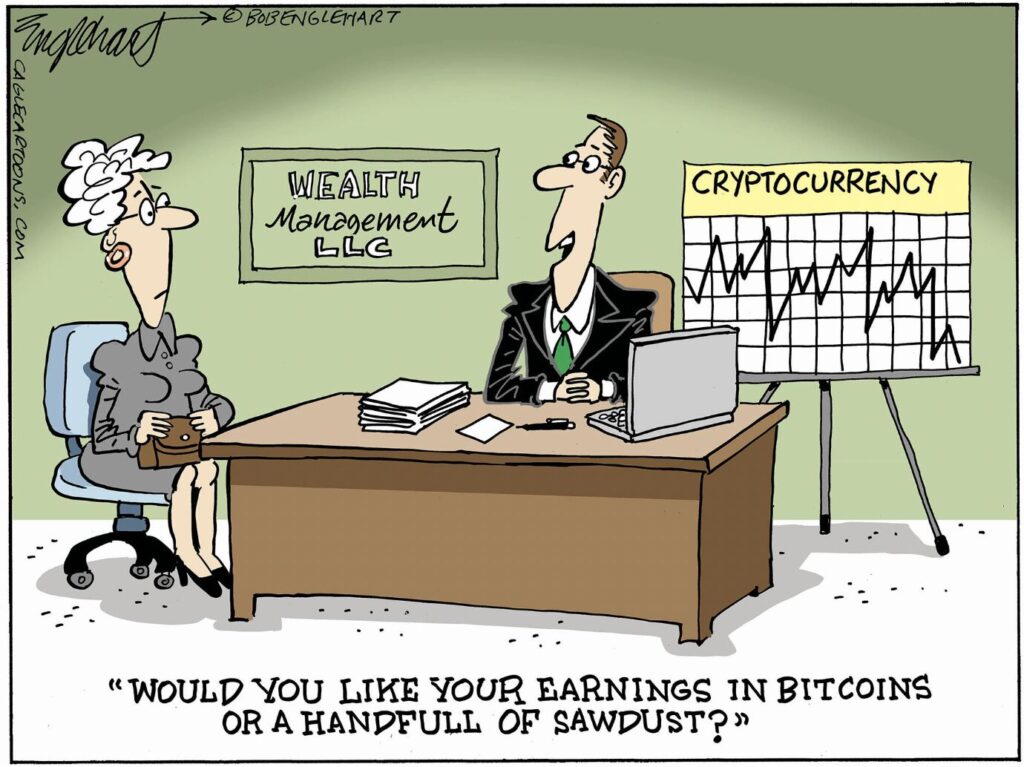

#cryptowinter is still strong and the macroeconomic situation is not making it any easier.

Folks at Binance and other key stakeholders in the decentralized infrastructure business, who were supposed to be the trail blazers of democratization of finance, are now talking like naive school kids.

This is the time we pick the bad seeds out (all types; individuals, ideas, practices) and let this revolutionary idea, that “one can truly control their own money and decide what they do with it without the need to trust and rely on central authorities”.