Amongst the various #crypto statistics making headlines everyday, this may not seem that relevant. But this is insane ! This market cap is comparable to the size of the biggest economies of the world, even though it is floating around $1.6 trillion in early 2023. Let me explain, and I understand the risk that I am probably oversimplifying this.

* A popular metric for representing the size of a country’s economy today is GDP. Gross domestic product is the monetary value of all finished goods and services made within a country during a specific period. Nominal GDP is calculated with current prices without accounting for inflation.

* The world’s largest economies today are #USA and #china with nominal GDP of $22.66 trillion and $16.64 trillion each. Then there is Japan, Germany, UK, India, Italy etc. all next on the list of the biggest economies in the world.

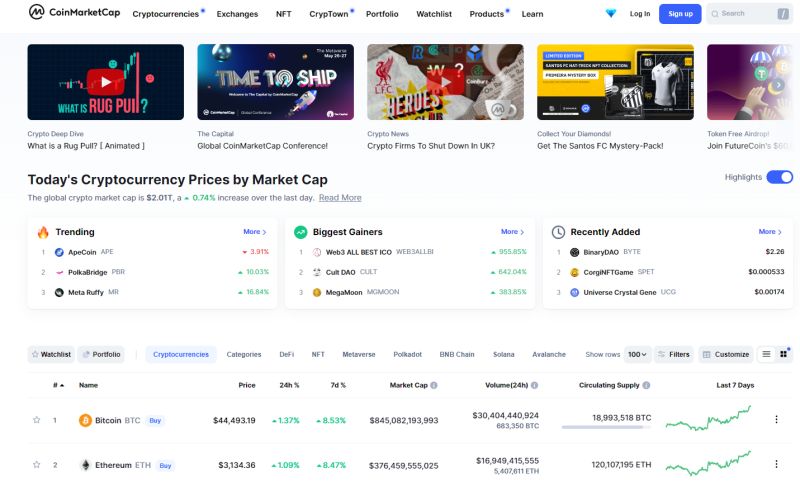

* Important thing to note is that the economies of India, UK, Italy, Canada, South Korea are all around the $2 Trillion size, so market capitalization of cryptocurrencies are now comparable to biggest economies of world.

* These economies are growing at an average rate of 3% to 5% annually, where as the #crypto market is growing at unprecedented rates.

So how does the various types of digital currencies contribute to this market size ? Well Money is of only two types ; regulated and everything else.

In my various conversations with industry peers, I have been trying to find a way to segregate the types of currencies or “money” that exists today. As I learn and find out more, the definition of my segregation changes.

* Based on who owns the issuance of “money” I started with “private money” and “public money”. Fiat being public and everything else is private.

* Then based on encryption. So there are crypto currencies and then there are other digital currencies which may not be really currencies or encrypted but still represent a form of money. Example wallets as store of value.

* Based on the type of platform they are issued on. Tokenized or account based.

* Digital currencies issued by the central bank and all others. CBDC and everything else; crypto, stablecoins, private bank coins etc. CBDC is not very developed yet, and doest add to the market capitalization of digital currencies.

As I understand more, the only relevant segregation of money, is based on whether it is regulated or not.It seems like for the near future, both regulated and unregulated money will co-exist.

This is one of the most polarising topics in the world today, but #decentralized #money is going places and the world will never be the same again.