Are financial technology businesses ready for the cbdc impact ?

The “impact” of central bank digital currencies, once adopted, is expected to run deep in the economy.

Central bank digital currencies are a type of regulated digital currency intended to bring the promises of the crypto revolution to centralized finance.

A CBDC will for sure impact the economy of a country, but the direction is still unpredictable. The results coming in from China are promising though.

For those in the financial technology business, strategic decisions around “Where to play” and “How to win” will have to be revisited.

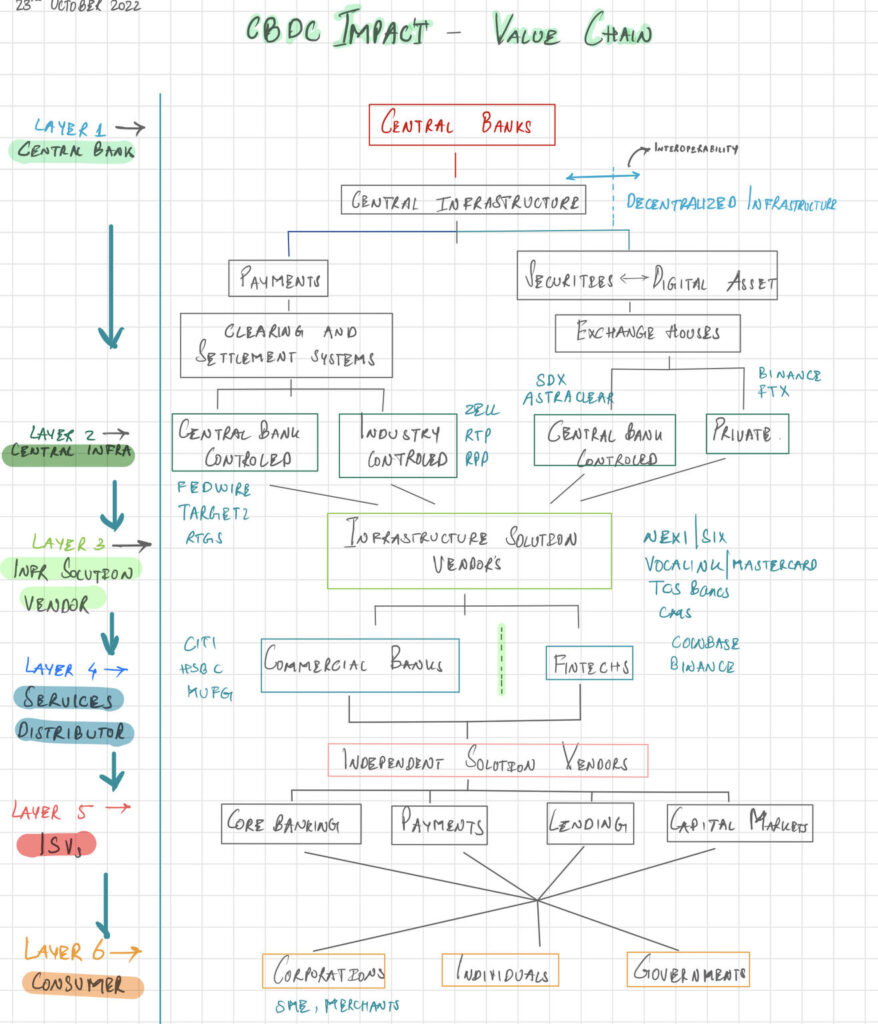

I believe there are multiple layers that would need change, and potentially open up close to their core strengths. These changes can make or break a financial technology business, but the cost of doing nothing, can be fatal.

The below image presents my view of the various layers that I believe will be up for disruption, as the new regulated money takes life.

Do you agree with it ? What other layers or areas would you add ?

Read More-